Everyone is familiar with consumer staples – e.g. groceries, beverages, home and personal care items – and many have a strong affinity for the underlying brands, with some brands having dominated their markets for generations (around half the world’s population use Unilever’s products daily). However, the consumer staples sector is often considered to be one of the sleepiest in the stock market. Kamal Govan investigates whether there is any opportunity to awaken investor interest.

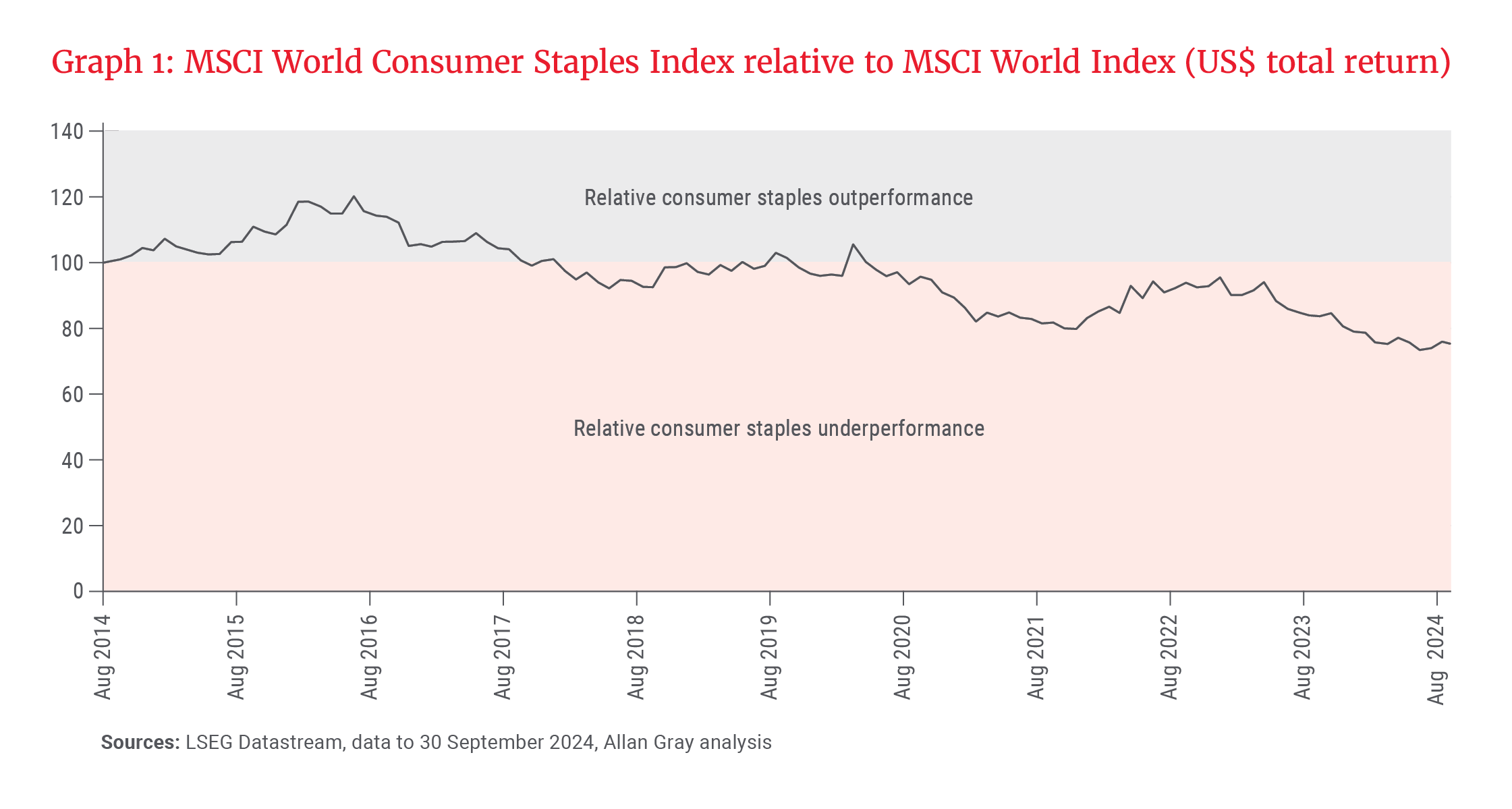

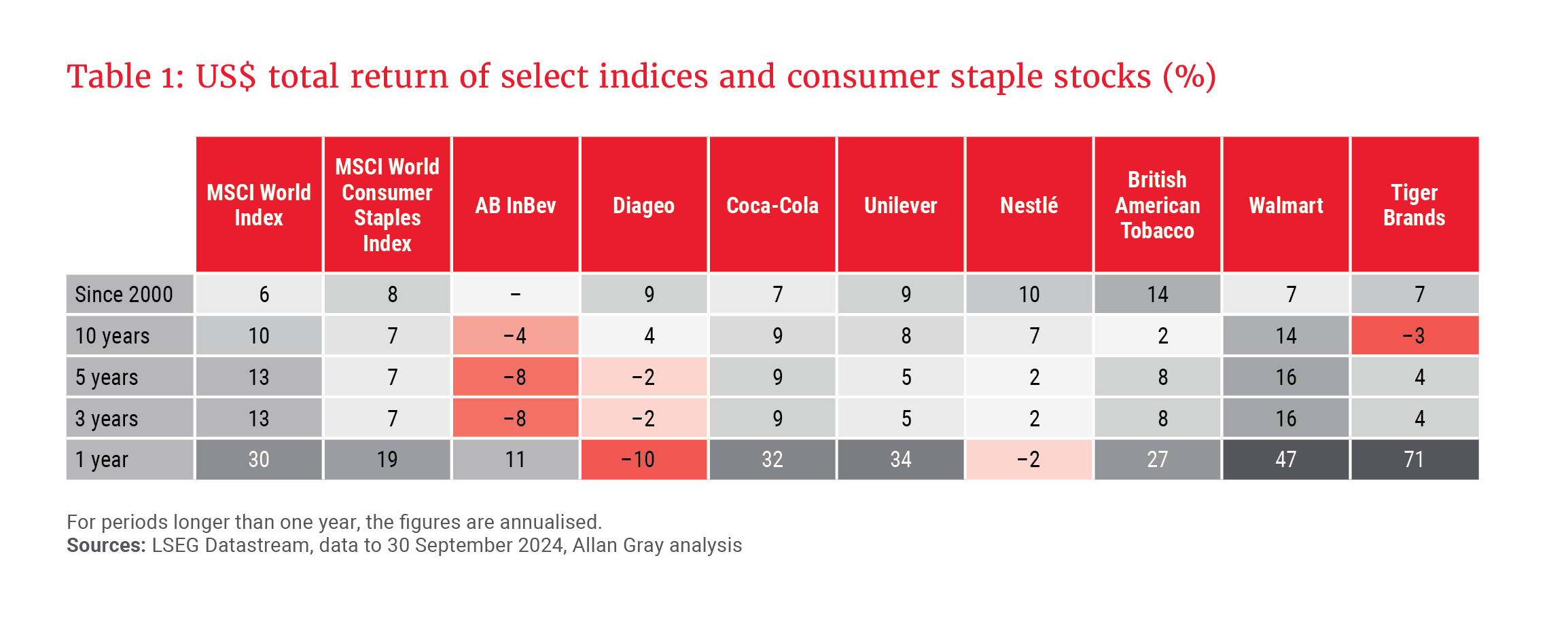

As the adage goes, a good business is not necessarily a good investment. The global consumer staples sector has underperformed the market, represented by the MSCI World Index, over 10 years, as shown in Graph 1. In fact, the performance of many consumer staple stocks has been disappointing over most time periods since the turn of the millennium (see Table 1). Are these companies fundamentally broken, or are there opportunities for contrarian investors?

Characteristics of consumer staple businesses

Investors typically seek out consumer staple stocks because they are considered to be defensive. Some of the important characteristics that underpin this belief are:

- Demand stability: Consumers buy staple products in good times and in bad, meaning that these businesses are less exposed to cyclical changes in demand. This demand inelasticity usually also applies when prices rise in a predictable way. Stable volumes and pricing translate into steady topline growth.

- Brand equity: Consumer staple businesses are not only home to many of the global megabrands, but also many much-loved local brands. Most consumers have some affinity for these brands, and purchasing decisions for these products are made almost subconsciously. Healthy brands create high barriers to switching.

- Pricing power: Strong brands and customer loyalty create pricing power. Good consumer staple businesses nurture their brands by consistently reinvesting in them. This drives sustainable profitability as healthy brands are more robust against changing economic and/or industry conditions.

- Scale: These businesses have mastered the art of managing large and complex manufacturing and distribution networks across the globe. Scale creates significant bargaining power with their suppliers, enabling them to manage product costs effectively and dominate shelf space in our favourite retail outlets.

Stable volumes and pricing translate into steady topline growth.

Relative to the average business, defensive businesses have more consistent earnings streams, which enable them to consistently reward shareholders with dividends. Not only that, but defensive businesses can also support higher debt loads through business cycles. This creates significant option value during difficult economic times.

Of course, all industries face risks and, for consumer staples, some of the noteworthy risks include:

- Absolute price levels: It is important to distinguish between inflation (i.e. the percentage change in price level) and affordability (i.e. the absolute price level). Balancing pricing power and affordability is especially important for those with outsized exposure to mass-market/commodity brands.

- Emerging competition: The fight for consumer attention and share of basket has intensified with the pervasiveness of technology. Private-label brands and smaller, local brands can reach consumers faster and more affordably than in the print-and-television-only era. Dynamic competitive environments may be good for consumers, but brands must have their fingers on the pulse to remain dominant.

- Changing habits: Consumption habits are changing, and this also impacts how brands should be engaging with consumers. Weight-loss drugs, for example, are becoming increasingly popular and are likely to impact products like packaged foods and sugary drinks.

- Complexity: Any business that has exposure to various categories, geographies, currencies and regulations is difficult to manage. A strong culture and attitude towards governance are important considerations.

Shelter from the storm

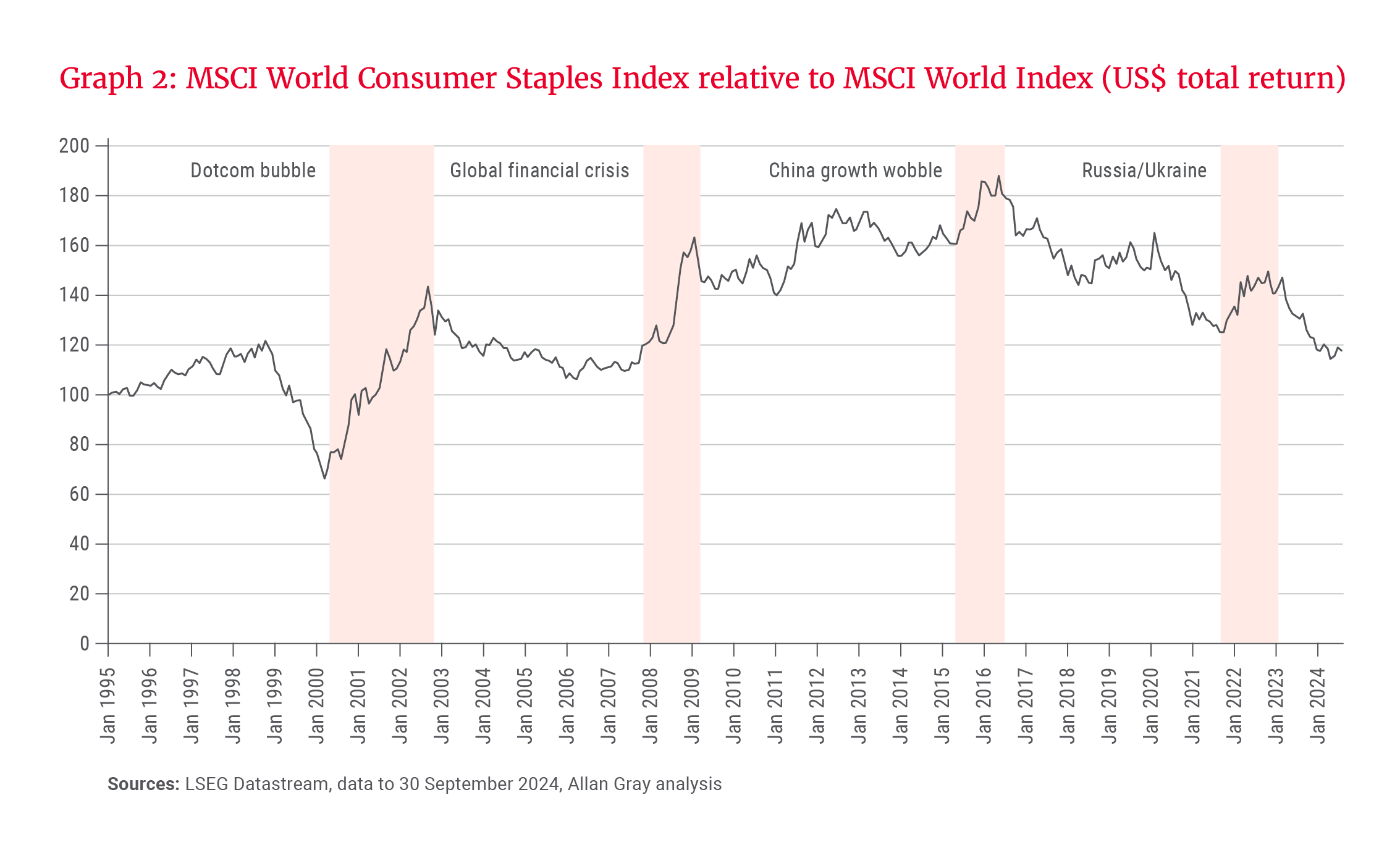

Consumer staples have historically provided investors with shelter during economic storms. Graph 2, a historical expansion of Graph 1, displays the significant and often-rapid outperformance of consumer staples during periods of significant economic stress.

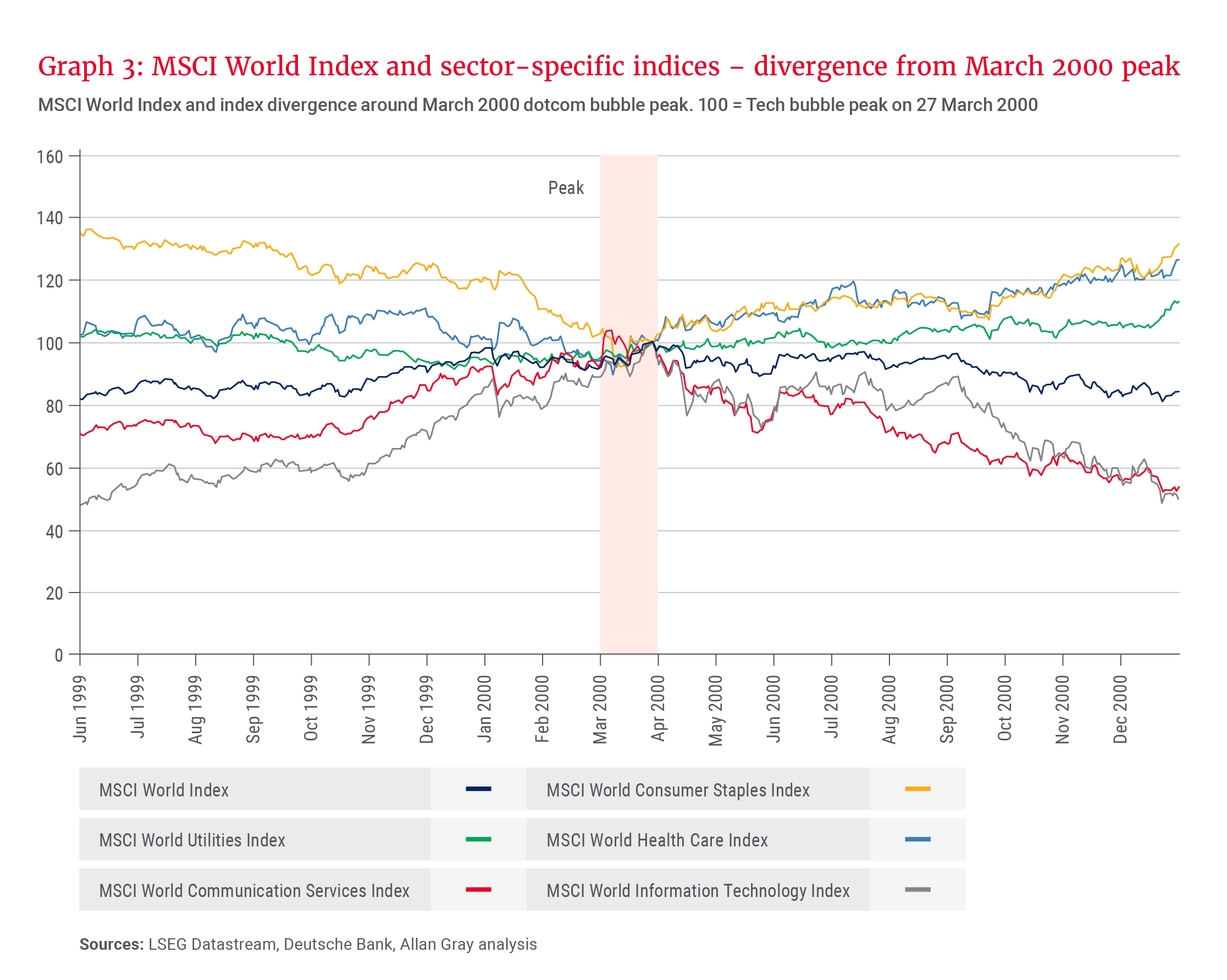

A deeper look at the period around the dotcom crash provides an example of how these stocks perform under economic stress (see Graph 3). Consumer staples and other defensive sectors, such as utilities, telecoms, healthcare and technology, underperformed in the build-up to the dotcom peak on 27 March 2000, however, these same sectors witnessed massive outperformance when the bubble burst.

Another consideration when investing in consumer staple stocks is where we are in the interest rate cycle. The sector is often seen as a stock market proxy for bonds due to the high, stable dividend yields of the underlying companies. In times of high interest rates, investors can substitute consumer staple stocks for fixed income investments. Conversely, in times of low interest rates, more value is attached to their dividend yields. It is perhaps fair to say that the current direction of travel for interest rates is lower.

Consumer staples have historically provided investors with shelter during economic storms.

Not all consumer staple businesses are created equal

Having made some arguments for owning consumer staples, the next question is why we own the ones we do. Long-time readers will appreciate that we do not select stocks based on overarching macroeconomic views. We are fundamental, bottom-up investors; we invest in companies we believe are undervalued and sell them when they reach our estimate of their true worth. Having said that, there are certain commonalities that we can draw from the consumer staples exposure in our portfolio. Broadly speaking:

- Stock prices are discounting low expectations relative to what we think is realistically achievable for each business.

- Each business has certain self-help measures that can improve our expected outcomes.

- Some balance sheets are geared, but none keeps us up at night.

- None of these businesses is overly reliant on China.

Selected investment case snippets

The Allan Gray Balanced Fund has about 14% exposure to consumer staples when factoring in both domestic and offshore stocks. British American Tobacco and Anheuser-Busch InBev (AB InBev) together make up just over 8% of this, while the remainder is diversified both locally (e.g. Tiger Brands, AVI Limited, Premier Group) and offshore (e.g. Asahi Group, Unilever, Diageo). Below, we highlight some of the aspects that add to their investment cases.

… we believe that our selection of consumer staple stocks provides us with a good combination of downside protection and sufficient self-help levers to improve their respective expected returns.

- British American Tobacco: This company has an attractive starting valuation that sufficiently discounts slowing tobacco use without necessarily factoring in the potential of its next-generation products business. There is potential for additional shareholder returns as debt reduces and more of its stake in Indian conglomerate ITC Limited is monetised.

- AB InBev: Margins are below our assessment of normal as 1) its higher-margin premium beer brands should grow faster than its core brands, 2) commodity/input cost pressures are moderating, and 3) the currency headwinds from emerging markets are easing. The business converts a high proportion of its earnings into free cash flow, and with debt more under control, shareholders should stand to gain from higher cash returns.

- Asahi: Trading at a discount to the market and its own history, Asahi is well positioned to benefit from premiumisation of beer throughout their markets in the EU and Oceania. The prospect of increased returns to shareholders from dividends and share buybacks is a material possibility.

- Unilever: Unilever implemented a clear strategic pivot to focus on their 30 “power brands” while increasing investment behind them, actively disposing of non-core brands/businesses, and simplified its organisational structure to speed up decision-making. Margins are expanding faster than anticipated and cash is being returned to shareholders from both dividends and a share-buyback programme.

- Tiger Brands: There is material upside if the turnaround strategy in the grains business proves successful, and there are early signs of improved execution. The company should benefit if South African economic growth accelerates.

In summary, we believe that our selection of consumer staple stocks provides us with a good combination of downside protection and sufficient self-help levers to improve their respective expected returns.