Since March 2022, local unit trusts have been able to allocate up to 45% of their portfolios anywhere outside South Africa. The increase in offshore limits is a significant positive for local investors, who now have greater potential to diversify across different markets, sectors and businesses. The South African equity market is concentrated and subject to emerging market, Chinese and commodity risks. Maximising the increased flexibility effectively requires a holistic view of the portfolio, which allows one to balance the opportunities and risks derived from its positioning. We believe that we are well positioned to do this, together with our sister company, Orbis.

In line with this thinking, the Allan Gray Investment team has been running a portion of the offshore allocation from Cape Town for the past year. Orbis, with its global investment team, continues to manage the majority of the offshore assets. Duncan Artus and Siphesihle Zwane look at the investment case for The Walt Disney Company, a position initiated by the Allan Gray team.

In a little over 100 years, The Walt Disney Company (Disney) has transformed from an animation house to a large happiness machine, with a content engine that creates characters and worlds that are monetised through film, streaming, consumer products and experiences. The business was founded in October 1923 by two brothers, Walt and Roy Disney, as a cartoon studio. Over time, the characters created in the studio were used for comics, merchandise and theme parks. This content-first operating model was famously sketched out by Walt in the 1950s, with the creative talent of studios and theatrical films at the core of the business.

It all started with a mouse

This content engine has been built out both organically – Mickey was designed by Walt and his chief animator in 1928 – and also inorganically, through some smart acquisitions over the years. Some of Disney’s main intellectual property (IP) assets and their sources are listed in Table 1.

Throughout its long operating history, the core of what Disney is has not changed, but the environment in which it operates has changed significantly – and we are certain this will continue to be the case. From its origins, Disney has had to navigate large technological advances, including the introduction of sound, then colour, in film, a move to computer-generated animation, and now a platform and distribution change from linear film and television to streaming.

Disney today

There are currently three main operating segments at Disney, with the first two closely tied to the content engine:

- Entertainment: This is the most popular part of Disney. It includes the loss-making but fast-growing direct-to-consumer (DTC) business (Disney+ and Hulu), the highly profitable but declining linear business (channels and networks) and the content sales and licensing business, which distributes content to third parties, including cinemas.

- Experiences: This is mostly the parks and experiences business and licensing and sales of consumer products. With the current losses in streaming, parks and experiences make up 54% of group operating profit, recovering well post COVID-19 shutdowns.

- Sports: This segment comprises ESPN and includes ESPN+ streaming. It does not benefit as much from the full content engine, but is a useful tool for streaming differentiation and bundling linear channels.

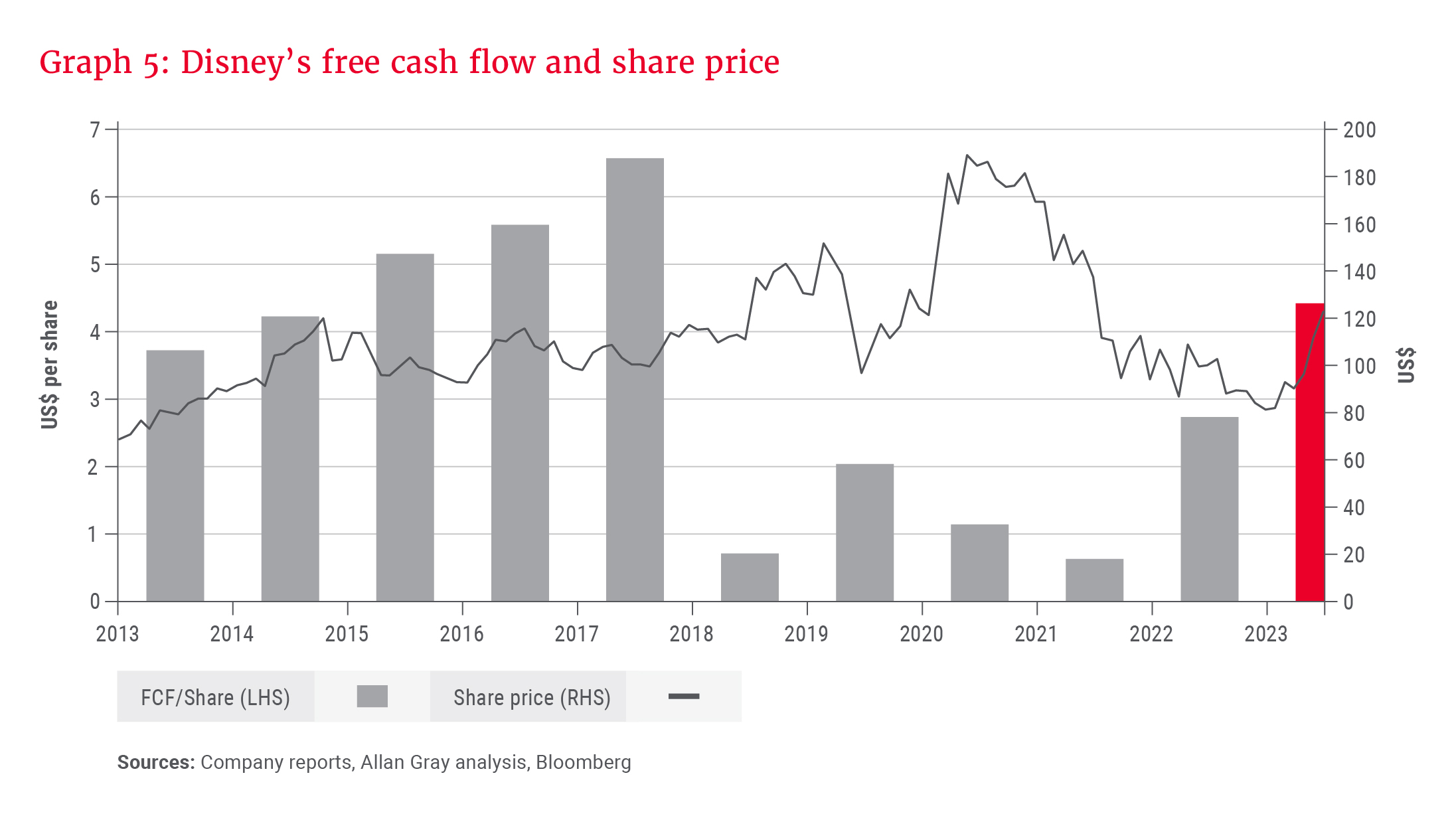

Graph 1 shows the key earnings segments before Sports was separately disclosed. A strong parks business, investment in DTC and a slowing linear market have shifted the earnings contribution over this time.

A whole new world

Linear television was a great business, bundling content to be on-sold by the cable provider at a price greater than the sum of its parts. A shift in platform, largely driven by Netflix, has changed consumer preferences and driven cord-cutting, as the cable bundle has become relatively poorer value for money.

Disney … launched Disney+ streaming in 2019, with more than 10 million subscribers on day one.

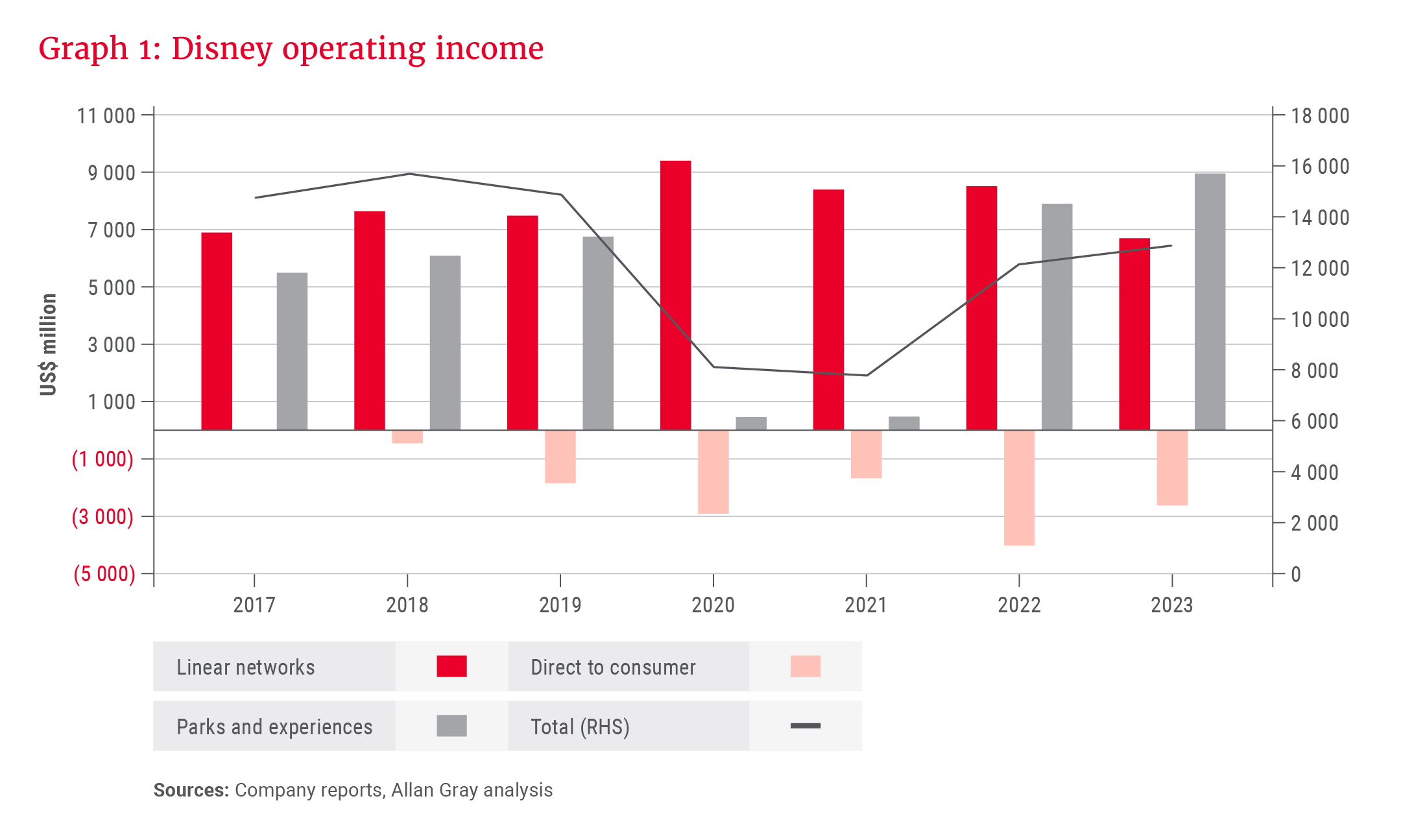

Cord-cutting has meant that content creators who distributed on linear channels have had to disrupt their own businesses or face a future in which they would be displaced by a strong competitor. Graph 2 shows this impact. US pay-TV households are down more than 40% over the last 10 years, while Netflix has more than doubled its subscriber base.

Disney had to adjust to this whole new world and launched Disney+ streaming in 2019, with more than 10 million subscribers on day one. In a world with no cost of money (zero interest rates), the market valued future profits similarly to current profits, generously rewarding businesses with high topline growth prospects, which were measured by subscriber growth for a streaming business. This swiftly changed as interest rates increased, with the focus quickly shifting to route to profitability, while Disney+ still made large losses.

We believe Disney has taken the correct strategic direction by focusing more on product quality than quantity.

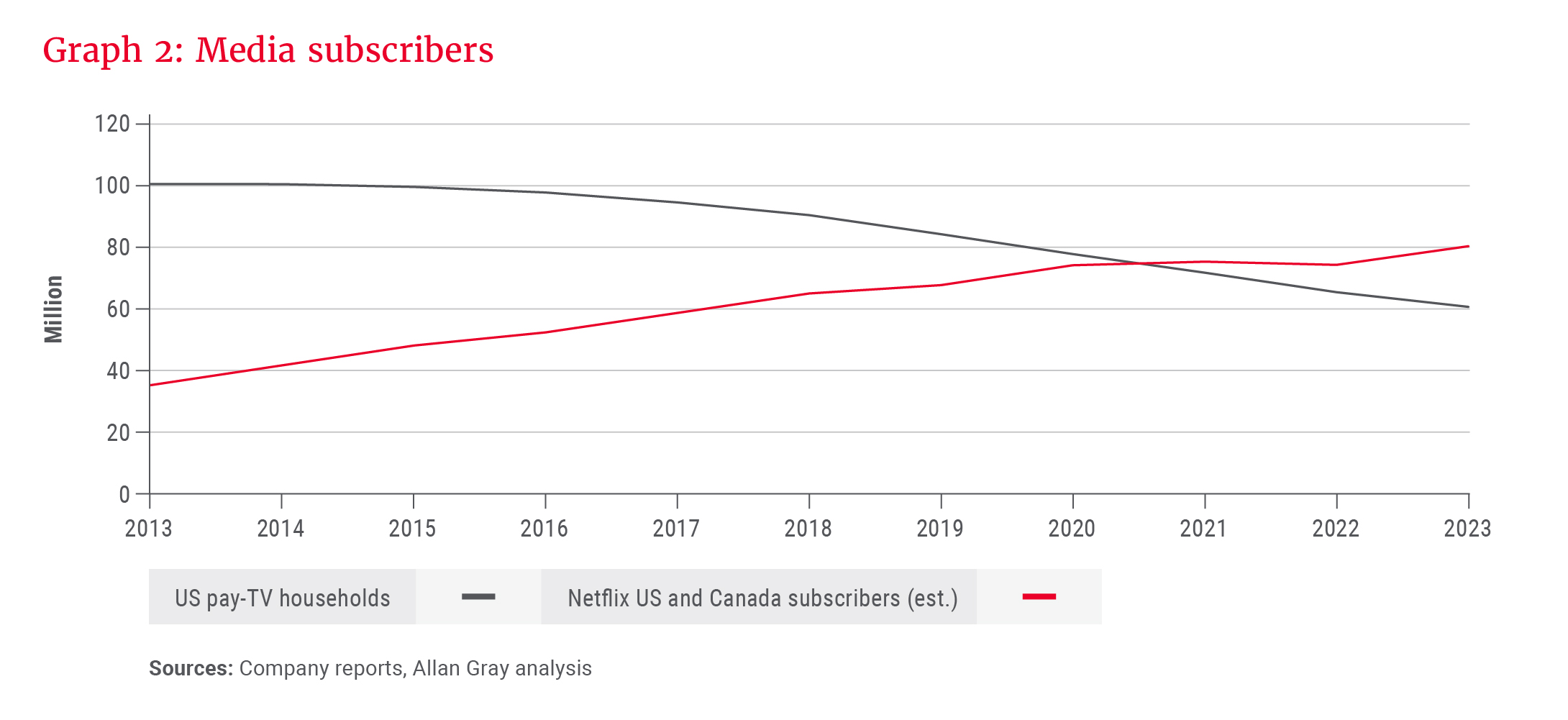

Disney, and most industry players, have started to improve profitability by cutting content, increasing prices, introducing advertising tiers, and clamping down on password sharing. Graph 3 shows the slowdown in content cost growth across the traditional linear players’ DTC platforms, with 2022 looking like the peak year for losses.

In addition to external industry disruption, Disney’s content engine, which is key for the operating model, began showing signs of weakness with poor box office results for some large-budget movies. The studio seemed to have strayed from an entertainment-first focus and kept pushing sequel after sequel, driving Marvel/Star Wars fatigue. The strength of this unique IP is meant to differentiate the streaming offering and has been a cause for concern for investors.

"The flower that blooms in adversity is the most rare and beautiful of all.” – The emperor in Mulan

What is the investment case?

It is not yet clear what exactly the industry structure will end up looking like amidst all the disruption, but we believe Disney has a reasonable prospect of success, with its 100-year track record of content creation, content library and distribution. This is valuable IP. Following, the prospects of the key businesses are discussed.

- Legacy linear: The linear entertainment assets, while in decline, are still very profitable, generating free cash flow and adjusting to a declining customer base. The company is open to divesting these assets at some point.

- Content: Superior content and franchise creation are core to the investment case. We believe Disney has taken the correct strategic direction by focusing more on product quality than quantity. This has not been the case over recent years. In addition, after a recent lean patch at the box office relative to expectations, Disney announced an “entertainment-first mentality”. Disney’s chief executive officer, Bob Iger, has openly spoken about a changed focus from messaging to entertaining. The business has been reorganised to restore authority and accountability across the content cycle to the creation teams, after these had been separated a few years ago. This makes sense to us.

The potential upside can be seen from the numbers: Disney had six of the top 10 streamed movies across all platforms in the US in 2023, and the studio business was number one at the global box office in seven of the last eight years. The movie pipeline for the next few years looks solid, with titles such as Deadpool & Wolverine, Inside Out 2, Avatar 3 and a standalone Mandalorian film. - Streaming: The focus of the market has been the financial trajectory of the DTC streaming business, which lost US$2.6bn in the 2023 financial year. There are signs that the financial performance has passed an inflection point as operating losses improved by US$986m when compared to 2022 and even faster in Q1 2024. Disney has now targeted profitability by the end of the 2024 financial year and a steady-state, double-digit operating margin, which compares to Netflix’s 21% margin, achieved after more than 17 years of operating. This will be helped by the buyout of Hulu minorities from Comcast, allowing consolidation of spend across platforms while improving the offering.

- Disney has also de-risked its Indian business, while retaining some optionality in the potentially large market. They have formed a joint venture (JV) between struggling Disney Star (formerly known as Star India) and the TV and streaming assets of Indian conglomerate Reliance Group.

- Sports: ESPN is probably the strongest sports brand in the US. We believe Disney can successfully manage the process of launching ESPN Flagship, a DTC streaming service, in 2025, despite the headwinds facing linear sports broadcasting. ESPN+, the current streaming service, is growing well.

ESPN also recently announced a JV with Fox and Warner Bros. to offer a skinny sports bundle to capture non-cable sports fans, and a sports betting JV with Penn Entertainment (formerly Penn National Gaming) called ESPN Bet. ESPN is a valuable bargaining chip to have in negotiations with other potential distributors and to combine with current packages like Disney+. - Experiences: The experiences business continues to be the primary monetisation avenue for Disney’s IP. It has produced strong returns through the cycle and provides an underpin to the value of the group. It has significant scale relative to other global leisure companies, and the parks and resorts would be difficult to replicate.

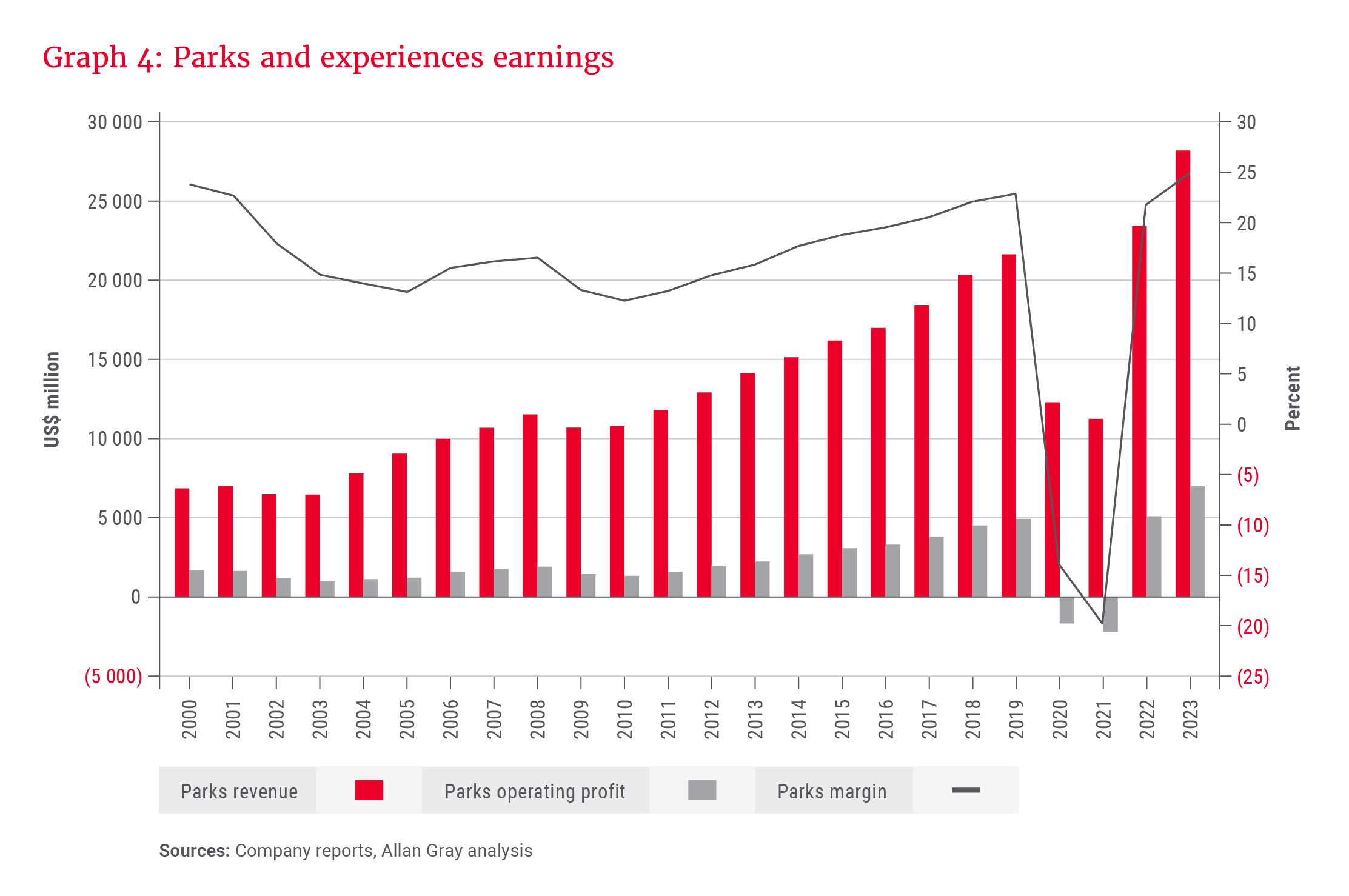

Disney’s confidence in the business was highlighted by the announcement of a US$60bn capital investment over the next 10 years into parks, resorts and cruises. Graph 4 puts the scale of the segment into perspective, as well as its track record in terms of profitability through the cycle.

While the share has performed strongly off its lows, we believe it still trades below its intrinsic value with additional upside optionality.

Valuation (The price of happiness?)

A share price that doesn’t reflect the underlying value of its key parts tends to draw in investors with a wide variety of capital allocation and strategy ideas and opinions. Disney went through this in 1983, when a corporate raider tried to take over the business, and continues to face similar investor agitations 40 years later.

While these events are likely positive at focusing management’s mind on shareholder value creation, it is not obvious that board seats agitated for by activist investors will lead to new ideas and insights. More important in the near term will be for Disney to make the right decision when choosing the next CEO, as Iger’s contract expires in 2026. We believe the current board has the experience to manage this succession.

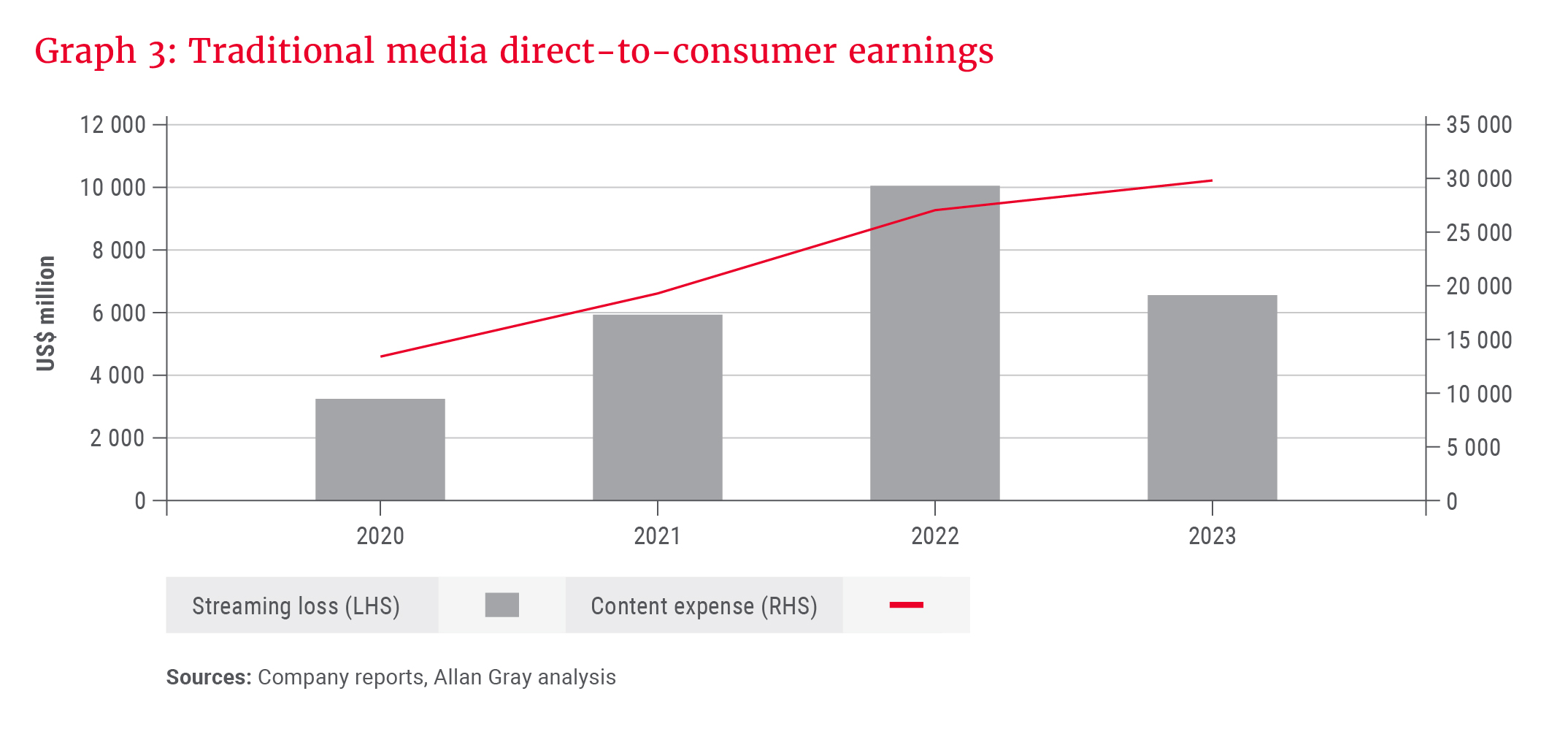

Disney trades on a forward price-to-earnings multiple of 25.5 times on what we believe are below-normal earnings. It has recently increased its cost-cutting target to US$7.5bn, which is 8.5% of 2023 revenue, and is forecasting more than US$8bn in free cash flow for 2024, moving towards pre-DTC investment levels, as seen in Graph 5. The balance sheet is in a reasonable position, with net debt to earnings before interest, taxes, depreciation and amortisation (EBITDA) of 2.4 times.

Management’s confidence was highlighted by reinstating a dividend and announcing a US$3bn share buyback. While the share has performed strongly off its lows, we believe it still trades below its intrinsic value with additional upside optionality.