It has been said that travel is the only thing that one buys that makes you richer. Consumers seem to agree with this sentiment, evidenced by an increasing shift in spending from owning things to a focus on experiences, of which travel has been a large component. This increase in travel has led to compelling investment opportunities in the sector. Varshan Maharaj delves into some of these.

In our quest to invest in undervalued businesses where we see long-term value for our clients, we have been attracted to the hospitality sector, where there are various opportunities worth exploring, varying by business model – choosing between hotel owners, brand owners, and online travel agents, and by location – owning businesses in South Africa or other regions. We have found businesses trading at attractive levels compared to our assessment of intrinsic value, with exciting options among the following:

- Hotel owners listed in South Africa (Southern Sun and City Lodge)

- Brand owners (Marriott and Hilton) and online travel agents (Booking.com) listed in the United States

These businesses have different investment cases, which are discussed below.

South African hotel owners

Southern Sun and City Lodge own and manage hotels, the majority being in South Africa. Hotel profit is driven by the number of rooms, occupancy of these rooms, and average room rates (ARRs). Furthermore, ARRs move together with occupancies, leading to large swings in earnings over the hotel cycle.

Hotels were placed under severe strain when they were forced to close during the COVID-19 lockdowns, which was followed by a period of operating with varying levels of restrictions, which have since been removed. These disruptions led to collapses in their share prices, creating buying opportunities. While earnings have recovered somewhat, they still remain below normal.

Supply-demand yo-yo

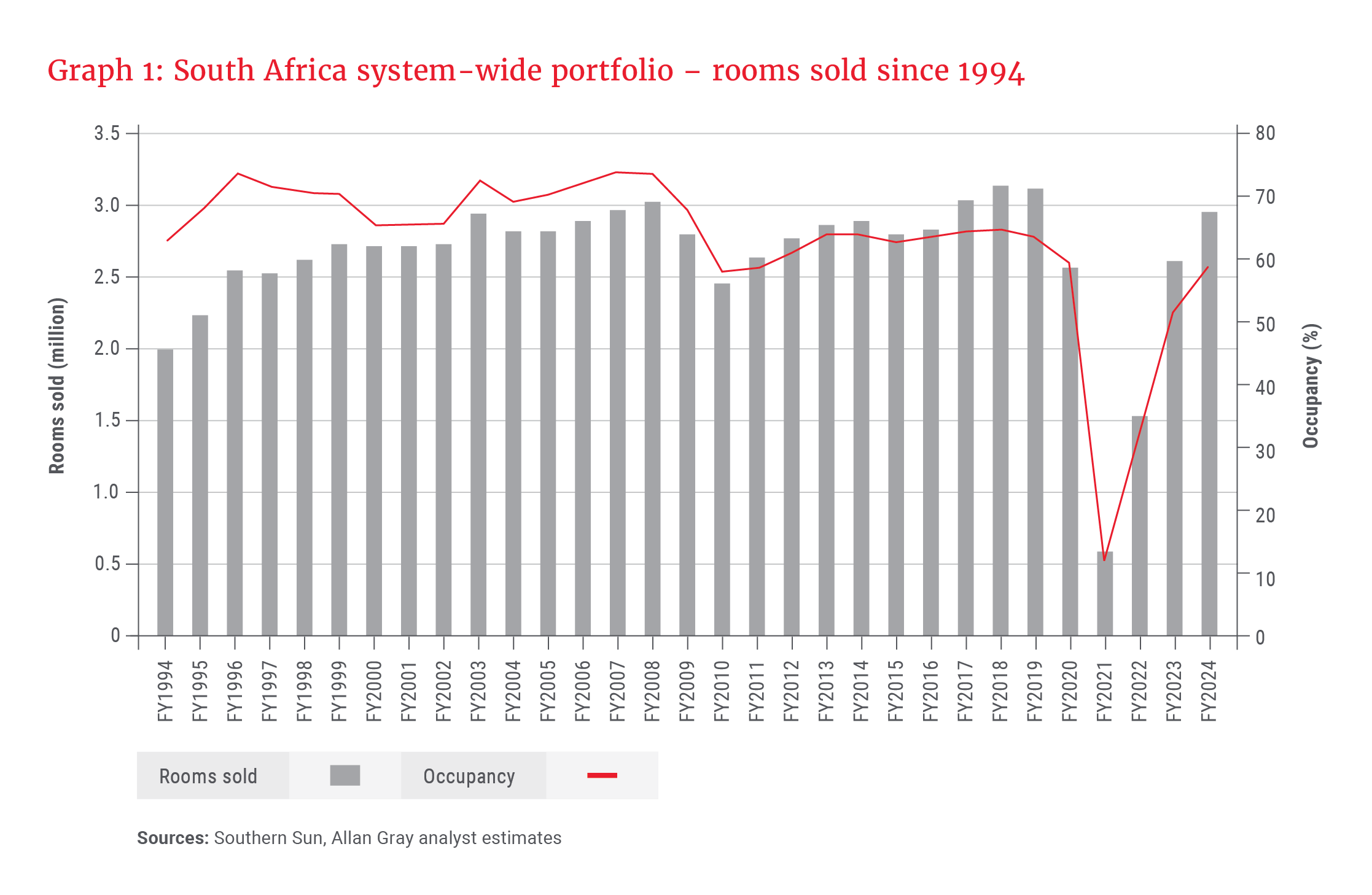

Despite consistent new supply, demand growth exceeded supply growth for most of the 1994 - 2008 period, with occupancies averaging 70%. The global financial crisis of 2008 constrained demand, but supply growth continued up to the 2010 FIFA World Cup. Occupancies fell from 74% in 2007 to 58% in 2010. Demand subsequently grew ahead of supply, leading to rising occupancies, which ranged between 61% and 65% from 2012 to 2019. Occupancies collapsed during COVID and have not fully recovered, as shown in Graph 1.

Southern Sun’s ARR for FY2024 was R1 388. Using the average exchange rate of FY2024, this translates to US$74. Hotels in comparable nations enjoy higher ARRs of US$120 to US$150. South Africa’s lower ARRs are due to relative oversupply. Profits are expected to grow as occupancies and ARRs move towards and beyond normal levels from the depressed levels attained during COVID.

Consider enterprise value per room

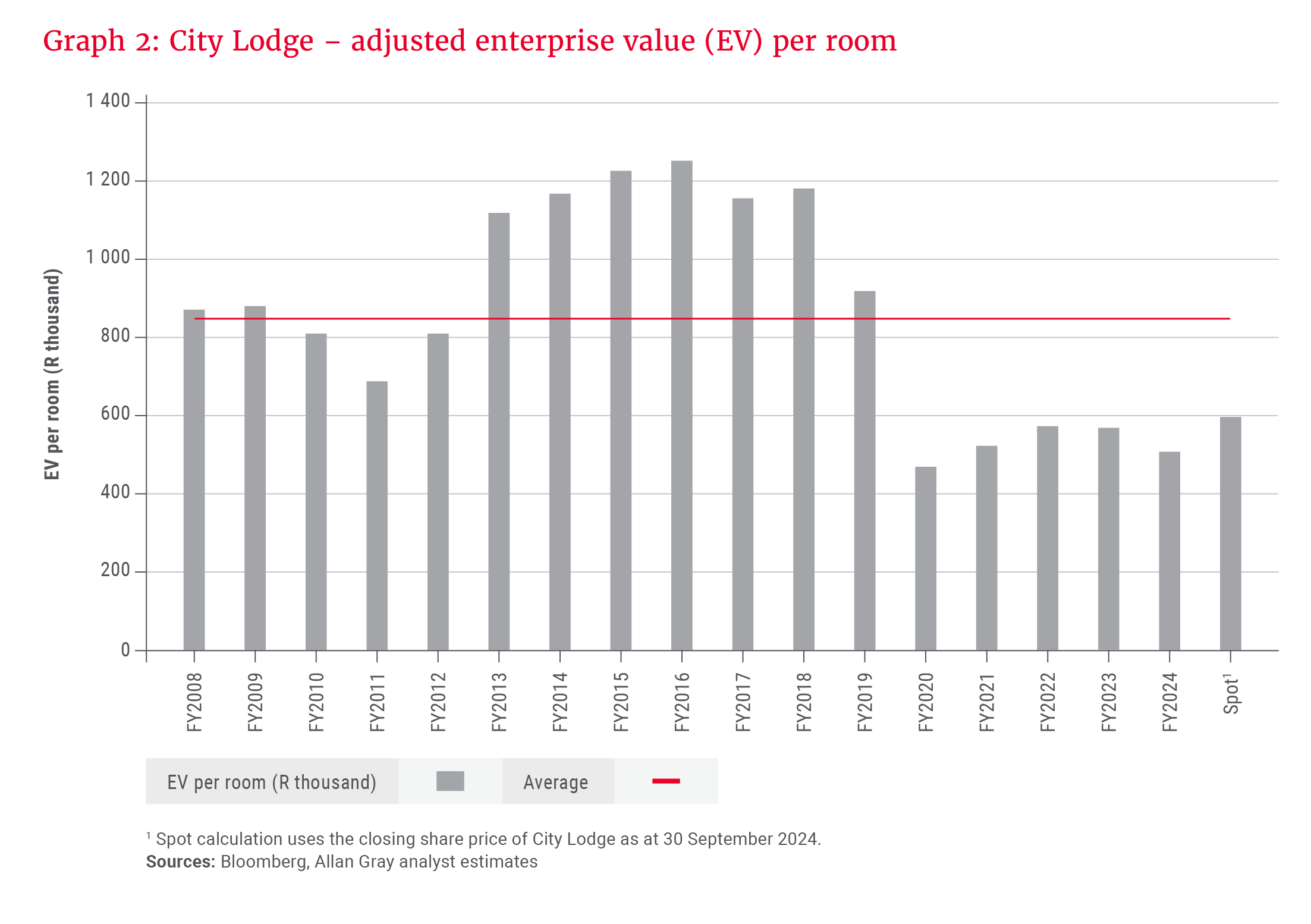

An alternative valuation measure that is useful in this sector is enterprise value (EV) per room. Using the closing share price as at 30 September 2024, Southern Sun trades at an EV per room of R913 000. Compared to a replacement value of over R2m per room, it offers considerable value to shareholders. Given that Southern Sun has only been separately listed on the Johannesburg Stock Exchange since 2019, investors may get a better indication of where hotel valuations sit relative to history by inspecting similar metrics for City Lodge, which has been listed for a longer period – see Graph 2.

City Lodge’s EV per room is low versus its history (and even cheaper if one were to adjust historic numbers for inflation), and versus our estimate of intrinsic value per share.

We also see upside optionality to both businesses via:

- Share buybacks while they are trading below fair value: Southern Sun did this particularly well, repurchasing 145 million shares in recent years at an average price of R4.57 per share.

- Crown jewels: Iconic hotels, such as the Beverly Hills in Umhlanga and The Westin Cape Town, are worth very high multiples of free cash flow, which are underappreciated in share prices – evidenced by the sale of Southern Sun’s Maia Resort.

- Operating leverage: Hotels have high fixed costs, so as occupancies and ARRs increase, profits increase in a non-linear fashion. For example, if occupancies were to increase by 10% and ARRs by R50, Southern Sun’s estimated profit could increase by about 50% from the FY2024 level.

Not without risks

With every investment, there are risks. Increasing occupancy rates and ARRs relies on economic growth, which may take a few years to materialise. Hotels are cyclical, but our assessment is that there are still some good years ahead.

American hotel brand owners

Marriott and Hilton have transformed their businesses over decades to become asset-light companies. This is different from listed South African hotel groups, which own the hotels. Around 99% of their hotels are owned by third parties, with Marriott and Hilton selling their brands, systems, and hotel management expertise to these hotel owners in exchange for a fee linked to the revenue and profits of the hotels.

The key determinants of investment success are the price one pays and the value you get from earnings growth, and the hospitality sector currently offers attractive opportunities at both ends of the spectrum …

Both groups own many brands, which cover most segments of the market. They also have large and popular loyalty programmes, which drive direct bookings and improve margins.

Understanding the business model

This business model depends on maintaining guest preference for their brands, and offering hotel owners a higher return on their hotels when being part of their respective ecosystems than they would be able to achieve as independent hotel owners. This is achieved via scale and intellectual property advantages in distribution and pricing.

These businesses trade on high multiples, which are justified by their high barriers to entry, good profitability, cash generation, scalable business model, and long runway to grow earnings per share (EPS) at 10% or more per year in US dollars. Their EPS growth algorithm may be summarised as mid-single-digit growth in hotel rooms, plus low-single-digit growth in revenue per available room, plus upside from growing incentive management fees and reducing shares in issue via buybacks. They have successfully applied this strategy for decades and are likely to continue to do so for the foreseeable future.

Their strategy is to maximise their number of rooms, funded using other people’s money, which makes earnings less cyclical than those of the hotel industry as a whole. The business model responds favourably to higher inflation, as revenues rise while hotel owners fund rising capital expenditure.

Platform businesses of all kinds, where growth can be plugged into an existing system with little to no incremental cost, trade on high multiples. The guest side and hotel owner side of the industry are very fragmented, and chains like Marriott and Hilton provide a valuable service by connecting both groups. They do an excellent job of keeping guests and hotel owners in their systems, as they have earned their trust and give them what they want (low prices and consistent experience for guests, with higher returns for hotel owners).

The skills to build and operate a hotel are different from the skills needed to distribute that capacity to guests. Hotel brand owners invest billions of dollars in distribution and loyalty systems, which are effective in reaching guests. Independent hotel owners cannot afford to do this themselves.

Marriott and Hilton regularly win awards for being among the best franchises to buy, suggesting that they offer hotel owners good relative returns, and their large and growing room pipelines are evidence of a preference for their brands. Being part of such an ecosystem can benefit hotel owners by securing additional bookings, access to superior administration systems, and lower procurement and online travel agent costs. Relative to other leading hotel chains, Marriott and Hilton hotels have significantly higher average occupancy rates and significantly higher ARRs.

Online travel agents

Booking.com is the world’s largest online travel agent (OTA) by revenue, offers 29 million accommodation room listings, and is dominant in Europe. It has a large competitive moat and benefits from monopoly-type network effects, as hotels are attracted to the OTA with the most customers, who, in turn, are attracted to the OTA with the most hotels. Their points of difference include wide choice, good user experience, and low prices. Booking.com captures a larger share of their customers’ travel spend by cross-selling flights, tours, dining and other experiences.

A challenge for OTAs creating loyalty programmes is providing a consistent stay experience. Booking.com has done well in this regard, with its Genius loyalty programme driving about 75% of its bookings.

Given the size of the global market, hotel chains and large OTAs can continue to grow, consolidating the pool of independent hotel owners, for many years to come.

Attractive investment opportunities

The asset-light model of the brand owners is superior to the capital-intensive model of owning hotels. The key determinants of investment success are the price one pays and the value you get from earnings growth, and the hospitality sector currently offers attractive opportunities at both ends of the spectrum, with South African hotel owners trading at less than half of their replacement cost, and the American brand owners and OTAs trading at reasonable multiples, while rapidly growing earnings.