In 2018, the US Department of Justice (DOJ) announced an investigation into Glencore for a violation of the US Foreign Corrupt Practices Act (FCPA), primarily related to its business in the Democratic Republic of Congo from 2007 to 2018. In this corporate governance case study, Raine Adams discusses our approach to researching and quantifying the risks to Glencore’s investment case.

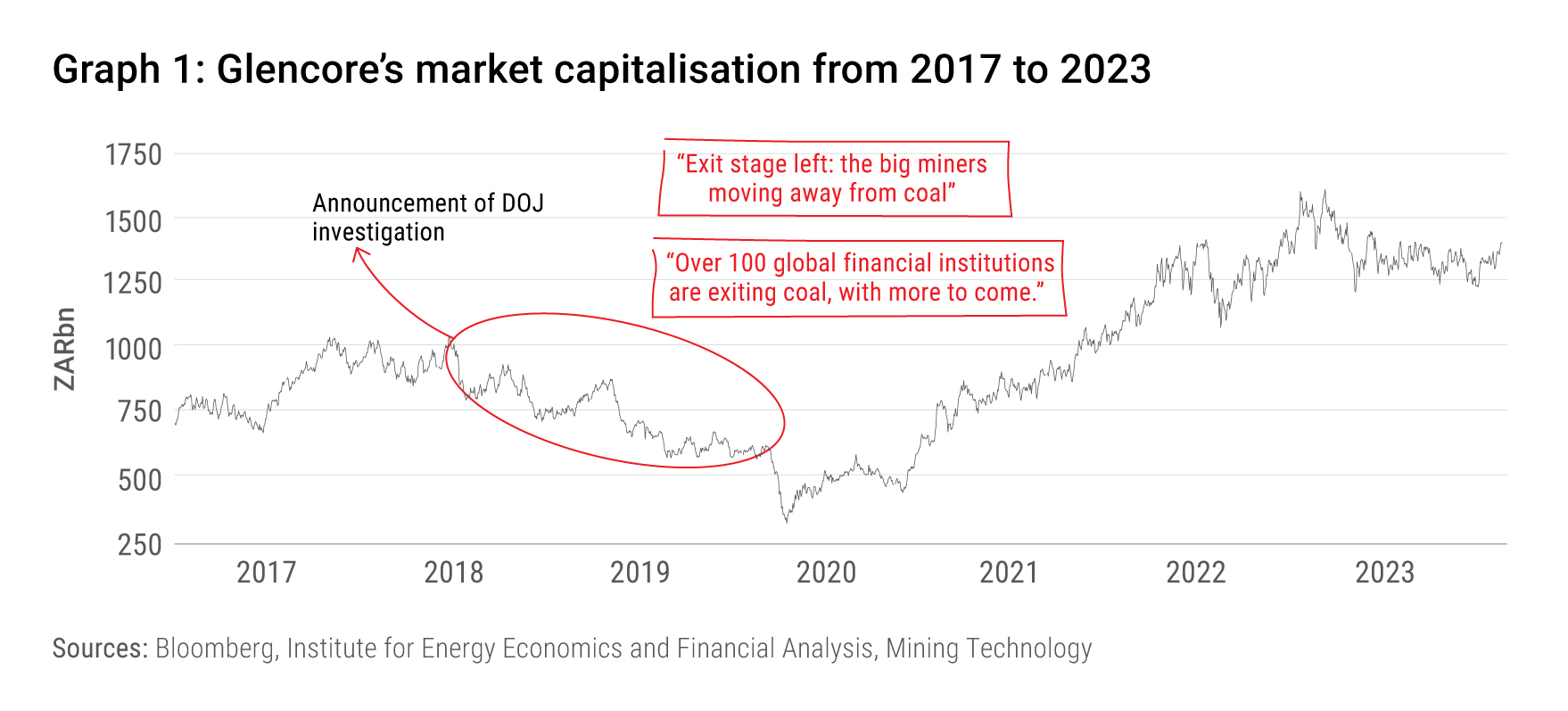

Glencore lost approximately 8% of its market value on the day of the DOJ’s announcement and continued to lose value over the next 18 months. This was partly due to the DOJ/governance overhang but also because it coincided with peak negative sentiment towards thermal coal, which affected Glencore as the world’s largest seaborne thermal coal producer.

Our Investment team adopted a three-pronged approach to researching the DOJ investigation and quantifying its risks to the investment case:

- We considered whether the corruption was pervasive and intrinsic to Glencore’s business model. In our view, it was not: Approximately two-thirds of Glencore’s through-the-cycle cash flows were generated in stable, more regulated jurisdictions.

- We evaluated whether there were signs of improvement in Glencore’s compliance and company culture. As part of this due diligence, we called for separate meetings with Glencore’s chair and general counsel.

Based on our meetings, we believed that Glencore was cooperating with the DOJ investigation and that strides had been made in its compliance programme. A key finding was that Glencore had now banned the use of local “middlemen” or intermediaries in negotiations with governments unless a very strong business case was presented to the Compliance department, and they approved it as an exception. We believed this would reduce the risk of corruption in future. We expressed support for this change and encouraged further enhancements. Our research into the FCPA showed that most companies enter into a plea agreement with the DOJ. As part of this process, they open their books up to a more global audit and/or allow for the appointment of a compliance monitor – an independent legal company which monitors a company’s compliance and internal controls for several years after a DOJ agreement has been reached. We believed that such an outcome would further reduce the risk of ongoing unethical conduct. As anticipated, upon settling with the DOJ in 2022, Glencore agreed to the appointment of an independent compliance monitor for a three-year period. - We undertook research into the FCPA and the likely size of the fine and associated costs to assess the financial risk. This included joining expert calls and evaluating former FCPA rulings in detail.

Based on our estimate of the FCPA fine and associated costs, our view was that the share price decline had created a sufficient margin of safety to invest. Our portfolio managers subsequently built a material position in Glencore on behalf our clients. It proved to be a good decision, making a strong contribution to investment outperformance in the following period. Graph 1 highlights share price performance over this period but excludes the benefit of dividends, which further contributed to our clients’ total return. Glencore’s ultimate settlement with the DOJ and other regulatory organisations in 2022 was in line with our estimates, based on research conducted in 2018. We subsequently continued to monitor FCPA fines.

This is one of the best examples we have of where deep-dive ESG research and engagement added value to the investment case. It also demonstrates that we are not opposed to investing in “ESG improvers” as opposed to “ESG leaders” when we can see a path for the gap to close. The latter presents an opportunity for an accompanying market rerating of the stock.

Of course, ongoing monitoring and engagement remains important. We subsequently discussed governance-related matters – such as the regulatory investigations, compliance and due diligence procedures, and corporate culture – with the chairperson and management at eight meetings. We also performed other channel checks such as informally asking employees about changes in the company’s culture.

Climate strategy: To unbundle or not to unbundle coal

Glencore’s climate strategy has been another focus area during engagements. For example, we met with the head of Sustainable Development on climate-related matters in 2022 and 2023, and we discussed its thermal coal strategy in detail at 10 meetings since 2018. We also called a meeting with Glencore’s coal modelling expert in 2019 to evaluate the company’s research into coal demand under various policy and climate scenarios (as compared to our internal research).

In 2023, following news that Glencore was making an offer to purchase Teck Resources and possibly unbundling the merged coal business, we engaged with Glencore and reaffirmed our previously communicated position that we were in favour of the original strategy not to unbundle coal but rather to “retain and retire”. Of course, Glencore has many stakeholders, many of whom would like the company to unbundle coal, and we recognise the conflicting pressures.

Glencore has subsequently completed the acquisition of a 77% stake in Teck’s steelmaking coal business. Management has not yet confirmed whether the steelmaking and thermal coal businesses will be unbundled post-acquisition, stating that they plan to engage with shareholders on an optimal strategy to unlock shareholder value post-acquisition.

ESG engagements: An ongoing process

Between 2018 and 2023, Allan Gray met with Glencore’s directors or executives 22 times and sent one letter to the board. ESG matters were discussed at all meetings given the materiality of ESG factors to Glencore’s investment case. Company representatives included the chair, CEO, CFO, company secretary, remuneration committee chair, head of Sustainable Development and other heads of department.

ESG discussion topics at meetings have been broad. Within corporate governance, key themes included compliance and ethics, management succession and remuneration, and board structure. Environmental discussions have centred on Glencore’s thermal coal and decarbonisation strategy within the global energy transition and, to a lesser extent, tailings management. Most of these meetings also include discussions around Glencore’s base metals basket, which presents a substantial opportunity in an electrifying world. Finally, social themes included safety, Glencore’s response to artisanal mining in the Democratic Republic of Congo, and how they ensure responsible cobalt mining and community relations in Cerrejón.

For more information about how we consider ESG factors as part of our investment process, please consult our latest Stewardship Report.