Since our inception in 1973, we have been privileged to witness the evolution of shareholder rights associated with JSE-listed companies. These rights have been instrumental in enhancing corporate governance. Over the past decade, we have observed significant strides in the executive remuneration landscape. A key focus in 2023 was the proposed Companies Amendment Bill. Allan Gray governance analyst Nicole Hamman discusses the multi-year consultation process, during which we have highlighted both our support for aspects of the bill, as well as our concerns about the unintended consequences for shareholders in other areas.

In 2017, the JSE Listings Requirements underwent amendments, ushering in annual advisory resolutions on executive remuneration. This crucial change provided a platform for dissenting shareholders to engage, granting minority shareholders a more significant voice in corporate affairs. This development empowered us to scrutinise executive remuneration schemes meticulously and advocate for structures that align executive pay outcomes with shareholder interests. That alignment is essential in fostering decision-making that enhances shareholder value while deterring actions that could potentially erode it. It is this impact on shareholder value that motivates us to continue our pursuit of well-aligned executive remuneration structures.

The proposed 2023 Companies Amendment Bill (“CAB”) seeks to integrate shareholder approval on executive remuneration into the Companies Act, which differs from the current process outlined in the JSE Listings Requirements. While we acknowledge that there is ample room for improvement in the current process, the key question for our purposes has been: For JSE-listed companies, do the proposed amendments under the CAB enhance the current process? In our view, in the CAB’s current form, the amendments do not. Given that the proposed amendments would change how we go about exercising our stewardship responsibilities over executive remuneration, i.e. the nature of shareholder rights and the frequency with which we engage with remuneration committees (remcos), we have a vested interest in the development of this important piece of legislation. We have participated in all three rounds of public consultation since the 2021 draft that first included shareholder approval on executive remuneration.

In framing our feedback during these consultations, we leveraged our experience of the current process. Our submissions highlighted the potential impact of the proposed amendments on the quality of executive remuneration schemes, the process of shareholder engagement and the quality of South African boards.

Our efforts on behalf of our clients

Submissions can either be made in our capacity as Allan Gray, through industry associations such as the Association for Savings and Investment South Africa (ASISA), or through professional forums such as the Institute of Directors South Africa’s Remuneration Committee Forum (IoDSA REMCO Forum). We advocated for an industry submission via ASISA. However, in 2021 and 2023, ASISA failed to garner enough member submissions to justify an industry submission. This outcome was disappointing, as we observed that participants representing the shareholder perspective were underrepresented throughout the public consultations.

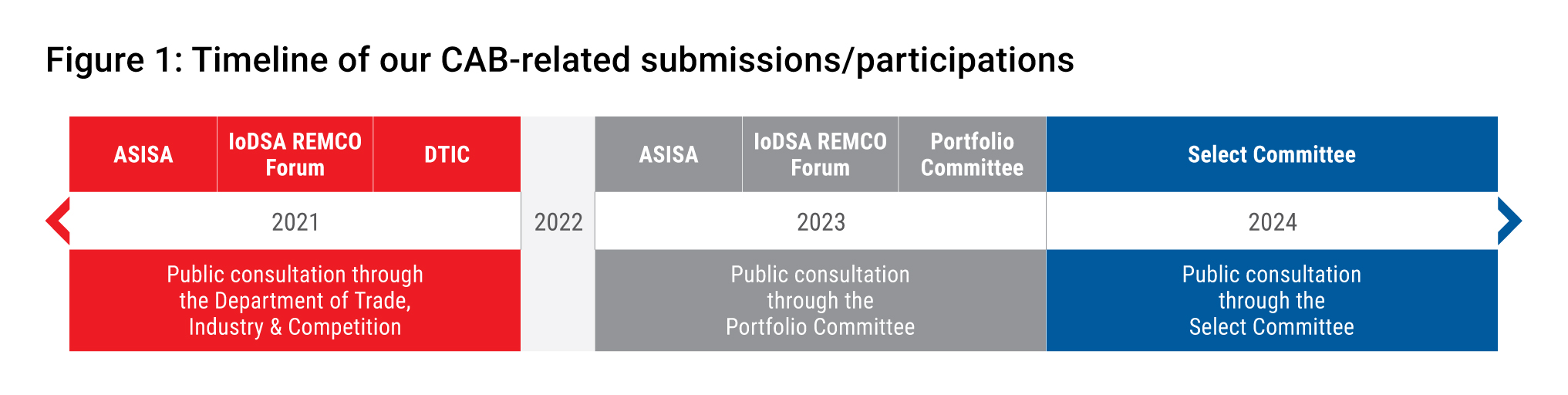

The IoDSA REMCO Forum is a diverse platform that includes representatives from institutional investors, remuneration committees, consultants and independent members occupying internal reward roles at issuers. Through our seat, we contributed to the REMCO Forum’s submissions in 2021, 2023 and 2024 as shown in Figure 1.

Drawing on our experience, we also provided feedback directly to the Department of Trade, Industry and Competition (DTIC) (2021), the Portfolio Committee on Trade, Industry and Competition (2023) and the Select Committee on Trade and Industry, Economic Development, Small Business Development, Tourism, Employment and Labour (2024).

Our key concerns with the proposed amendments

Remuneration policy

Under the current process, JSE-listed companies table their remuneration policies and implementation reports on an annual basis. Where more than 25% of shareholder opposition is obtained for either resolution, issuers are required to invite dissenting shareholders to engage. As a result, shareholders have the opportunity to engage with remcos when remuneration resolutions obtain 25-49% shareholder opposition. We make use of these opportunities: Since the JSE introduced these advisory resolutions, our clients have voted on 990 executive remuneration resolutions, and we have held 196 remuneration-focused engagements. The aim of our engagement is to be constructive by highlighting our key concerns and providing remcos with practical recommendations for improvement.

The traditional structure for an executive’s performance-pay structure involves an annual short-term incentive (STI) measured over a one-year period and an annual long-term incentive (LTI) most commonly measured over a three-year period. In South Africa, the remuneration policy includes the LTIs’ performance conditions and their respective financial targets for the upcoming three-year measurement period. Annual engagement on remuneration policies has served us well: We have been able to encourage companies to include suitable performance conditions and set robust financial targets, as it is particularly difficult for remcos to amend these incentives once they have been awarded. The annual policy engagement therefore acts as a meaningful soundboard for remcos to hear shareholders’ concerns while they are still in a position to make improvements.

Under the CAB’s proposed amendments, many aspects would change: Remuneration policies would only be tabled every three years, provided no material changes are made, and the resolution would be an ordinary one, which requires 50% shareholder approval to pass. In practice, only 2% of the JSE’s top 100 companies’ remuneration policies obtained below 50% shareholder approval over the five-year period from 2019 to 2023. In our view, this is not a reflection of the high quality of remuneration policies, but rather the predominance of average policies that are not poor enough to get voted down, largely due to the nature of shareholder makeup. Given concentrated ownership structures in South Africa, an ordinary resolution threshold of 50% fails to accommodate scenarios where minority shareholders are strongly in opposition. Even if the JSE Listings Requirements remain unchanged and issuers need to invite dissenting shareholders to engage when they receive more than 25% opposition, how efficient would that engagement be if issuers have already obtained the 50% support required by the Companies Act?

In the United Kingdom, remuneration policies are tabled every three years. As a result, companies tend to update policies once every three years. While locally the implementation report is proposed to be tabled annually, the policy dictates the bounds of the implementation. If the remuneration policy is weak, the shareholder rights on the implementation report will not carry much weight. We are concerned that the loss of meaningful shareholder engagement and the reduced resolution frequency will slow the pace at which policy improvements can be made, ultimately affecting the quality of remuneration schemes.

Consequences for remco members

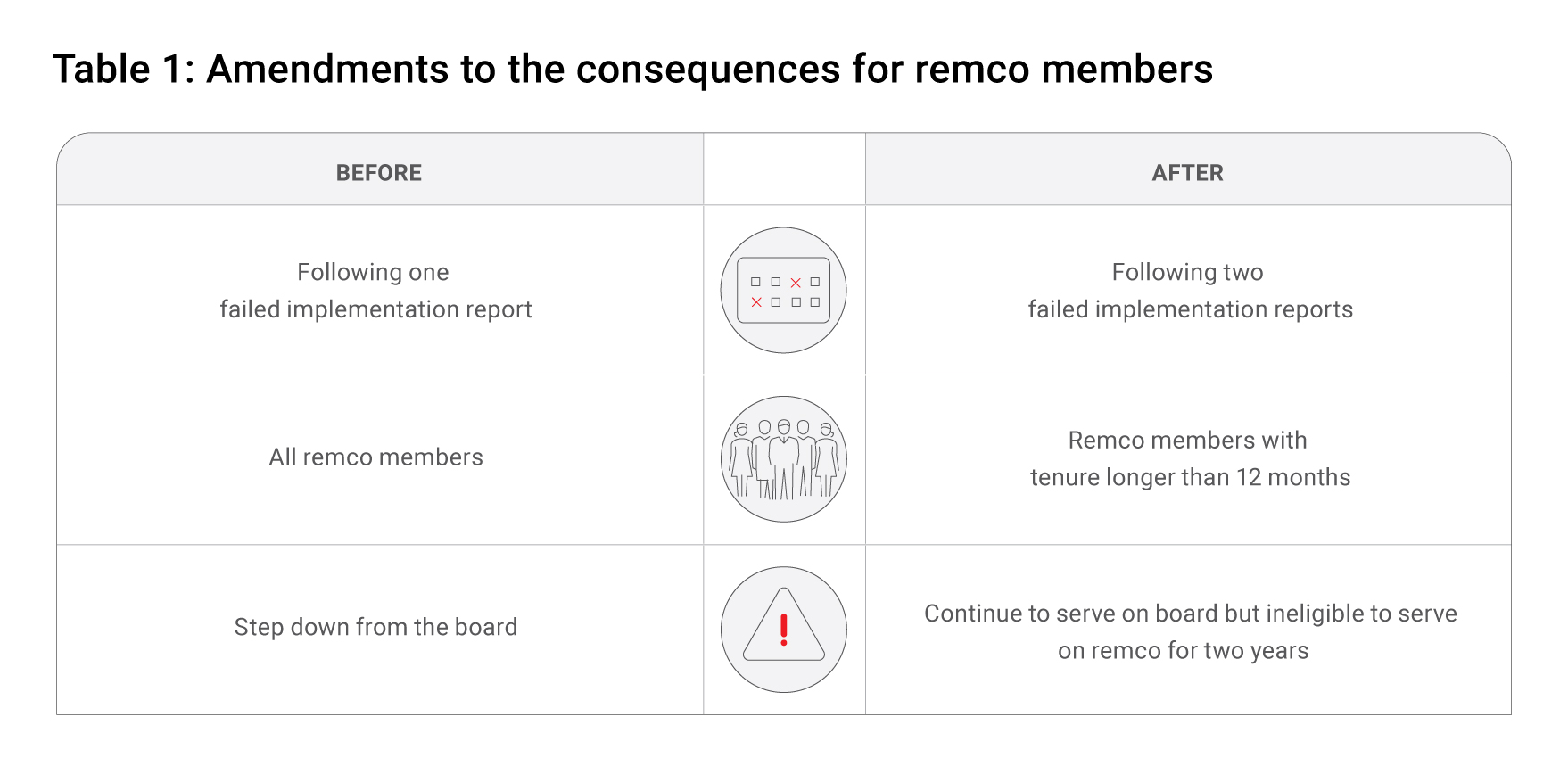

Under the current process, one-third of non-executive directors stand for re-election annually. Depending on the size of the board, this typically means the remco chair stands for re-election in their board capacity around every three years. The CAB proposes direct consequences for remco members following successive failure of the implementation report resolution. Table 1 shows the development of this proposal. Initially, it was very hostile towards issuers, requiring all remco members to step down following one failed implementation report. The latest version is less punitive and introduces a safeguard – the consequences only apply to remco members who have served for more than 12 months, and the consequences follow two successive failed implementation reports. In the event that this happens, remco members will be ineligible to serve on the remco for two years. Table 1 illustrates the value of public consultations, as some improvements have been made.

This proposed amendment to the consequences for board and remco members has been an area where both issuers and shareholders have expressed the same concerns during the consultation processes. The main concern is that these stringent consequences will have the unintended effect of diminishing the value proposition of serving on remcos. We echoed these concerns in our submissions. Remco members have a specialised skillset. Our key concern is that it is unlikely that remco members will continue to serve on the board should they be declared ineligible to serve on the remco. To ensure a balance of views, it is important that remco members are experienced and can provide an independent voice that challenges management and remuneration consultants, especially as remuneration consultants employed by management become more prevalent. The high turnover of directors resulting from this amendment could diminish the quality of individuals serving as directors and impact the quality of executive remuneration schemes. In our experience, positive shareholder activism requires time, and remcos require time to build relationships with management and shareholders in order to get improvements over the line.

We acknowledge the need for director accountability in the current process. However, we believe the consequences should be more balanced so as not to deter participation of non-executive directors on boards. Our suggestion throughout has been that the remco chair should be the ultimate accountable party who stands for re-election following two successive failed votes, instead of all remco members.

Going forward

We will continue to monitor developments relating to the CAB, particularly how the JSE Listings Requirements will be amended should the CAB be enacted. At the time of writing, the CAB is with the president for assent. Overall, we advocate for a balanced outcome, where shareholder rights are preserved while the quality of boards and executive remuneration schemes are not compromised.

For more information about how we consider ESG factors as part of our investment process, please consult our latest Stewardship Report.