We often write about large individual equity positions in our portfolios, but this quarter, Duncan Artus focuses on the opportunities and risks in “SA Inc” – the local domestic shares we own that earn a material portion of their profits in South Africa.

SA Inc shares, such as retailers, banks and property REITs, are currently top of mind for many investors. This is unsurprising – not only because the recent election caused much uncertainty, but also because their share prices are depressed when measured in US dollars and valuations are low relative to history, as shown in Graph 1, which reflects the forward price-to-earnings (P/E) ratio for the market.

How did we get here?

The cumulative effect of years of anaemic economic growth and poor governance of the country, combined with the recent political uncertainty, has pushed up the cost of capital, or required rate of return, via higher government long-bond yields. This has stifled investment (projects need to have high prospective returns to be approved) and resulted in low valuations being placed on South African companies' earnings streams. This is simply the mathematics of it. This trend was recently exacerbated by investors unwilling to take on risk, waiting on the sidelines until the outcome of the election was known.

To calculate the implied, or “fair ”, P/E that we should pay for a business, the equation looks like this:

P/E = Dividend payout ratio/(required rate of return - growth)

One can immediately see that the combination of a high cost of capital (required rate of return) and low expected growth rate results in a low P/E.

Of course, any positive (reduction) move in government bond yields or increase in growth estimates could result in an upwards rerating from these depressed valuations and price levels. Unfortunately, the opposite is also true. So, what is to be done?

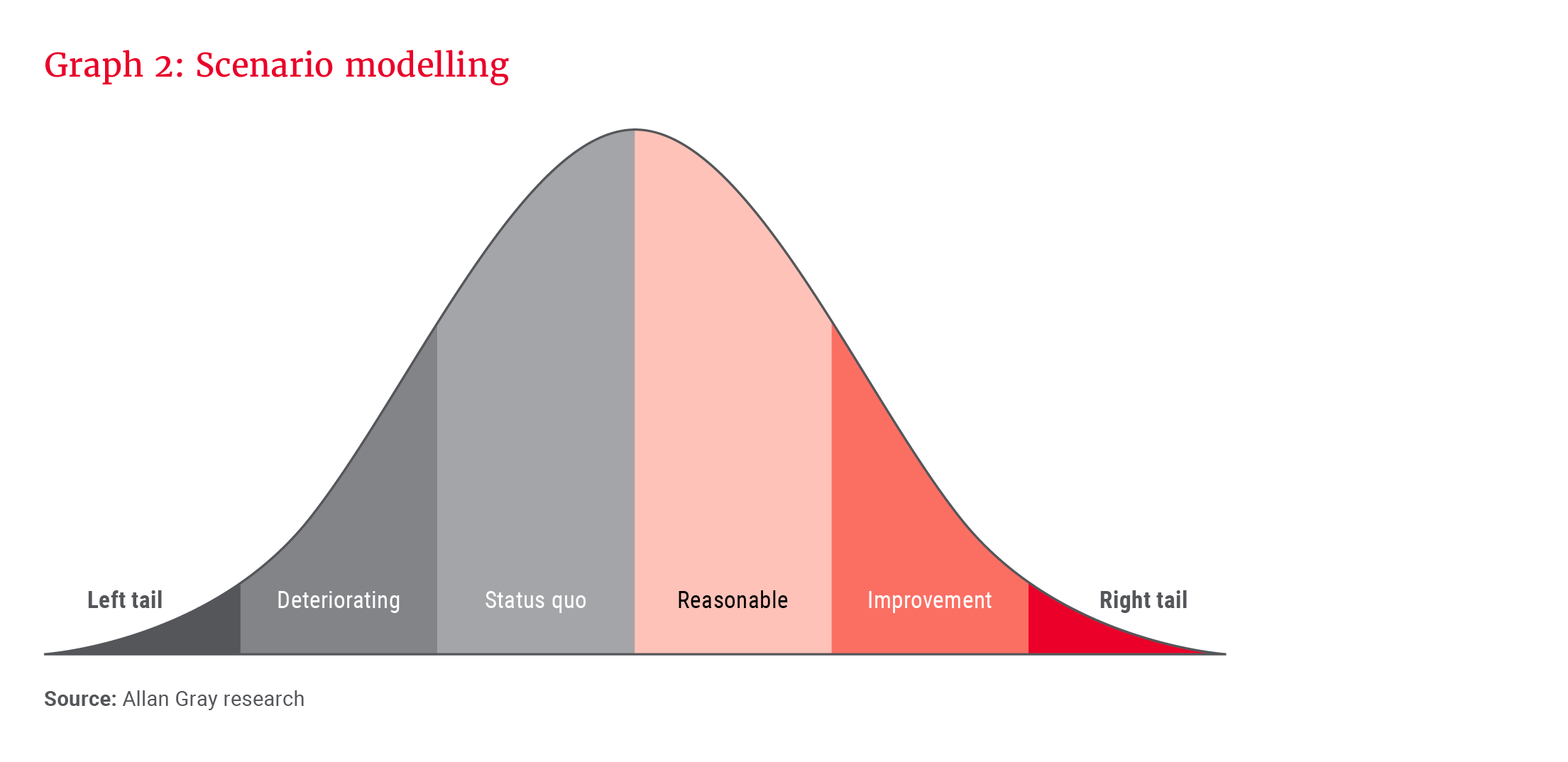

We believe it is best to consider different scenarios and construct a portfolio that could benefit in those scenarios, but skewed to the ones you think have the greatest probability of occurring. We also focus on the tails, both left (negative) and right (positive), and think how various shares will behave in those scenarios. One could naturally bet on one scenario, but we don’t think that is prudent.

We believe running a successful asset allocation fund requires a holistic view of the portfolio, which allows us to balance the opportunities and risks derived from our positioning.

Graph 2 shows how we think of the various scenarios facing South Africa’s economy and asset prices, with the red areas being positive and the grey areas negative.

While it is still very early days in South Africa following the election, at the time of writing, we seem to have avoided, or at least reduced, the probability of the left-tail risk scenario (a sharp move to radical economic and social policies). Allan Gray has been managing funds in Africa outside South Africa for 13 years, and we have direct experience of the economic consequences of the left-tail areas on the curve, such as the currency collapses in Nigeria and Egypt and the difficulty in creating broad-based wealth. I personally also have the more pleasant experience of a right-side positive economic and investment return scenario.

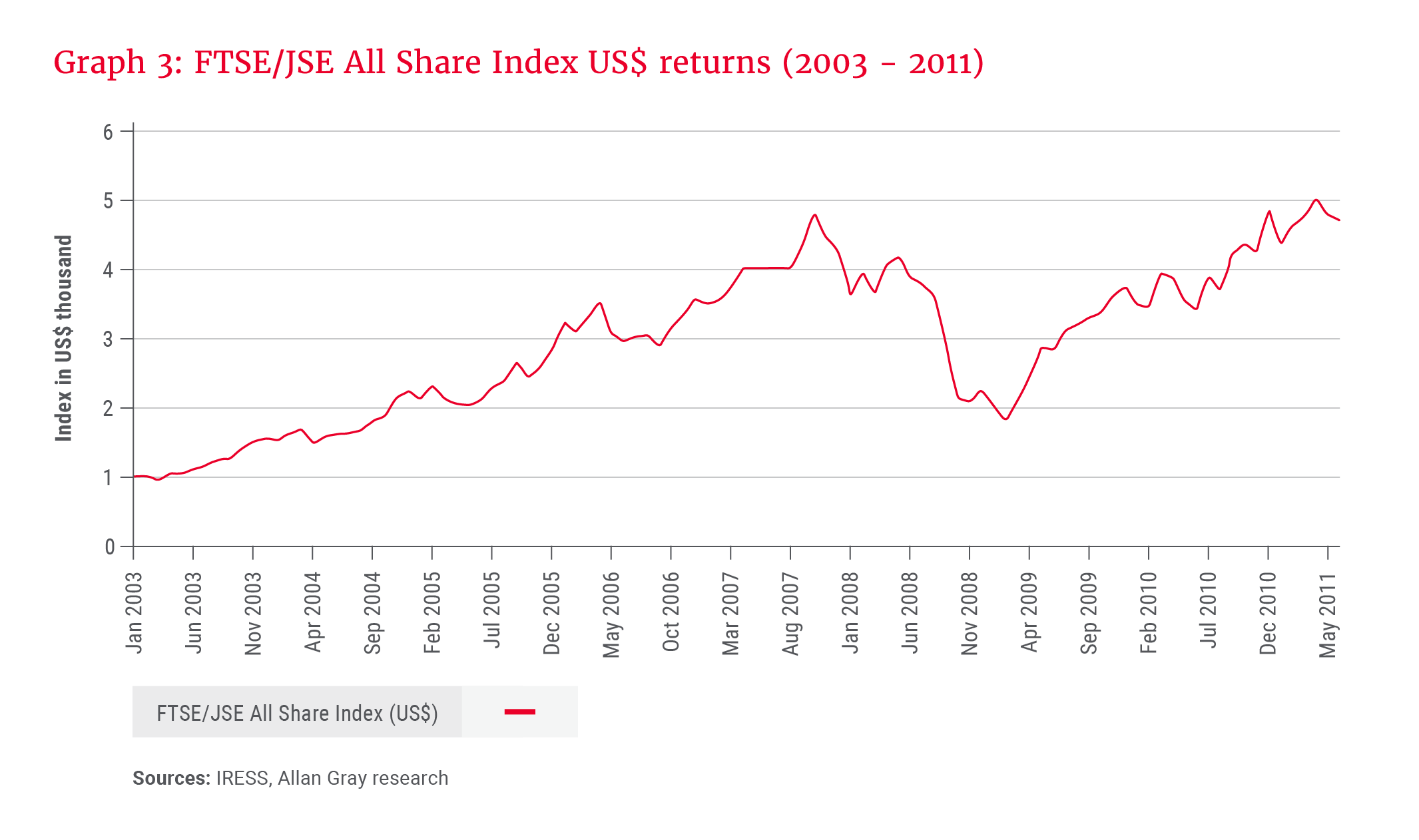

Many market commentators forget about the 2003 - 2011 period when South African equities delivered strong US dollar returns (despite being interrupted by the global financial crisis sell-off), as shown in Graph 3, and many of the SA Inc shares attracted high valuations and were emerging market investor darlings.

Positioning our portfolios for growth

One could argue that the job of the boards and management teams of SA Inc is to protect their businesses and keep them in a competitive position to benefit from a potential right-tail scenario. This is clearly easier said than done, given the economic environment they are operating in, but it could turn out to be a valuable option. We do not believe that the earnings of most SA Inc shares are above normal; we believe that their bottom lines could benefit materially from a higher revenue growth environment and lower interest rates. There is therefore the opportunity to benefit from both an increase in earnings and the valuation multiple applied to them.

... we have deliberately constructed diversified portfolios for a wide range of outcomes.

Our portfolios hold a number of these depressed SA Inc shares that have the potential to rally significantly in a right-tail scenario, as we saw when the initial discussions around forming a government of national unity were announced. Foreign investors are underweight South African markets in aggregate, so they could provide another source of buying demand. Emerging markets are depressed relative to US equities, and South Africa would benefit from any increase in sentiment towards emerging markets in general. There is also the possibility of further buyouts of South African companies by foreign suitors, as we have seen in the case of MultiChoice. The encouraging thing about the low valuations is that you don’t always need the favourable scenario to occur to make reasonable returns.

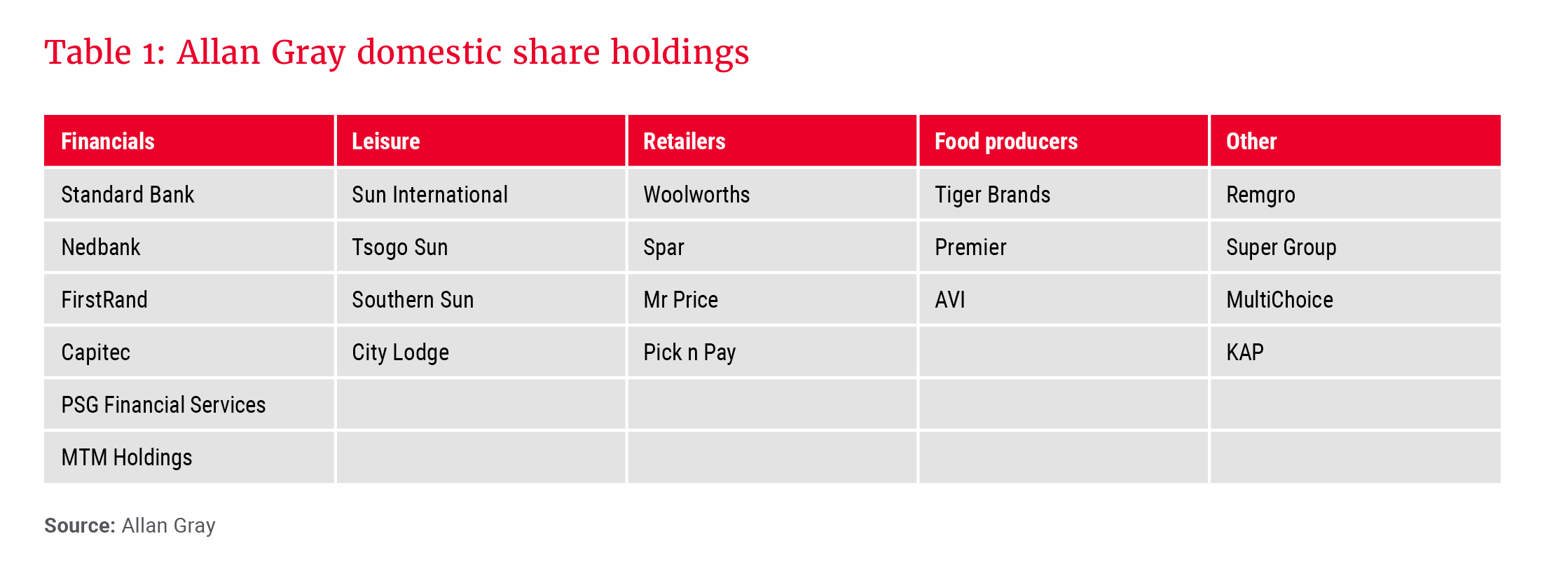

Table 1 highlights selected domestic-focused shares we own. Some of these businesses are in better financial and competitive positions than others, but collectively we think they are attractively valued.

The underlying fundamentals would have to start improving to support any increase in share prices that discount a better scenario upfront, otherwise we risk a repeat of the years post the Ramaphoria rally of 2018, when South African equities performed poorly as fundamentals disappointed relative to expectations.

Of course, South Africa still faces significant social and economic headwinds, and it will be a Herculean task to overcome these successfully, no matter who is running the country. The fiscal situation, which we have previously referred to in our commentaries, is in far worse shape than in the early 2000s. Some difficult decisions will need to be made in the future to make our finances sustainable. Unfortunately, the left-tail scenario will always be lurking in the background, like the Demogorgon monster in the Netflix hit series Stranger Things. We take this into account in our portfolio construction.

We remind our clients that we have deliberately constructed diversified portfolios for a wide range of outcomes. The portfolios have exposure to offshore assets, locally listed shares that are international businesses, attractively valued domestic businesses, high-yielding cash and bonds, as well as precious metals. While there are clearly fewer levers to pull in a domestic-only portfolio, we apply the same principles.

We believe running a successful asset allocation fund requires a holistic view of the portfolio, which allows us to balance the opportunities and risks derived from our positioning.