We are pleased to announce the launch of the Allan Gray Interest Fund (the Interest Fund) and the Allan Gray Income Fund (the Income Fund), which are now available for investment. At Allan Gray, we aim to keep our fund range focused. We only introduce new offerings after careful consideration, and where we believe the additions will better help our clients meet their goals and objectives. The new funds broaden our fixed income range, offering clients a more comprehensive selection of lower-risk and building block options. Vuyo Mroxiso explains the rationale, describes the new funds and discusses the role that they can play in clients’ portfolios.

The past few years have witnessed an increased demand for funds that have little to no equity exposure. While this has partly been cyclical due to the weak return and risk-off environment locally, we believe the shift to lower-risk funds has also been driven by structural factors. Advisers and fund aggregators are increasingly using “building block” funds to create their own multi-asset class solutions. Additionally, many investors employ the “bucketing approach” in managing their retirement assets, with income-generating funds forming a key component of the short- to medium-term buckets of these retirement planning strategies.

It is against this backdrop that we have introduced the Allan Gray Interest and Income funds. We believe the new funds are useful options for the more conservative investor seeking an income yield and higher returns than traditional money market funds, while maintaining a high degree of capital stability. Additionally, the funds serve as good building blocks for investors who prefer to construct their own portfolios. For those investors who prefer the enhanced cash and income components to form part of a holistically managed multi-asset solution, we believe the Allan Gray Stable Fund remains an optimal solution.

What are the objectives of our two new funds?

Allan Gray Interest Fund

The Interest Fund seeks to generate higher returns than bank deposits and traditional money market funds, while maintaining capital stability and low volatility, by investing in select South African interest-bearing securities. These primarily consist of floating-rate notes, money market instruments and fixed interest paper with a low duration. Returns are likely to be less volatile than those of traditional income and bond funds, but more volatile than those of money market funds.

Allan Gray Income Fund

The Income Fund seeks to generate income and produce returns that are superior to traditional money market funds, while preserving capital and minimising the risk of loss over any one- to two-year period. The Income Fund invests in a broad range of South African interest-bearing securities, such as floating-rate notes, inflation-linked bonds, fixed-rate instruments and money market securities, with limited exposure to offshore interest-bearing securities. While the Income Fund can have limited exposure to equities and property, we expect this to occur infrequently and to typically coincide with unusual or extreme points in the valuation cycle. Returns are likely to be less volatile than those of bond-only funds.

Where do the new funds fit into our fixed income fund range?

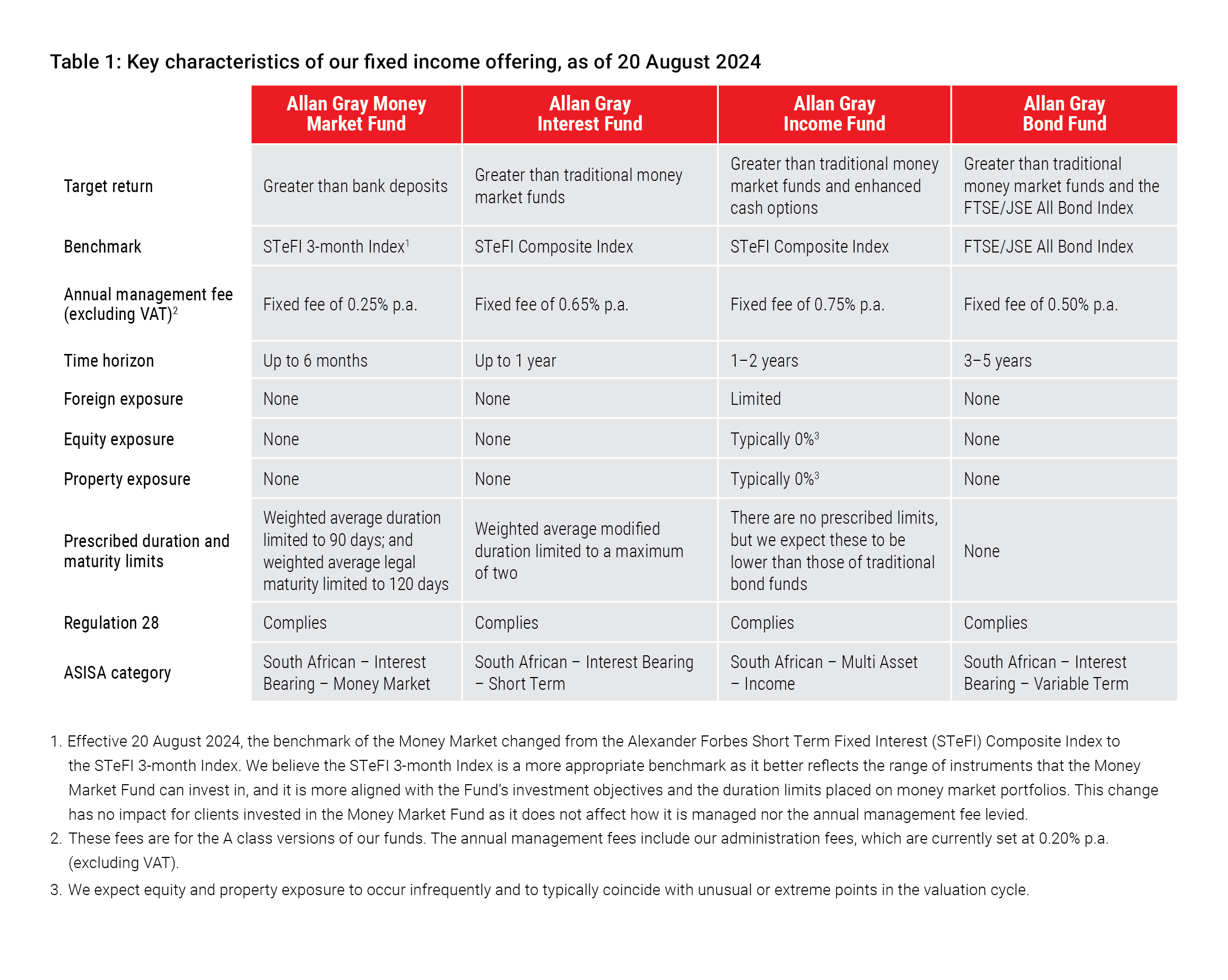

Similar to our other fixed income funds, which are included in Table 1 below, the Interest and Income funds are primarily intended to be used as building blocks. The Interest Fund typically does not take on materially greater credit risk than we do in the Allan Gray Money Market Fund (the Money Market Fund), but rather lends to similar or the same entities for slightly longer periods in pursuit of enhanced returns. As the Interest Fund can invest in longer-dated instruments with a higher-term premium or spread, we expect it to generate returns which are higher and slightly more volatile than those of traditional money market funds. For clients with an investment horizon of up to one year who seek a domestic-only interest-bearing fund, we believe the Interest Fund is a better alternative to traditional money market funds, since it is not subject to the same duration restrictions imposed on money market portfolios which can constrain the return potential of these funds.

While the Interest Fund has a more flexible mandate than the Money Market Fund, the Income Fund, in turn, has more flexibility than the Interest Fund: The Income Fund has no prescribed maturity or duration limits and has the ability to invest in offshore interest-bearing securities when these assets offer a more appropriate balance of risk and reward. This fund may also have limited exposure to equities and property, although we expect this to occur infrequently. We manage the Income Fund with a relatively lower risk appetite than traditional bond funds, particularly from a modified duration perspective. As such, we typically expect the Income Fund to sit higher up on the risk-return spectrum than the Interest Fund, but lower than the Allan Gray Bond Fund (the Bond Fund).

In keeping with our other fixed income options, the Interest and Income funds charge fixed management fees. We believe fixed fees are more appropriate for funds where the chances of them experiencing extreme under- or outperformance over their investment horizons are likely low.

How we manage fixed income

At Allan Gray, we have a 46-year history of managing fixed income mandates, and specifically 25 years since we started managing fixed income within the Allan Gray Balanced Fund in 1999. We currently manage over R145bn in fixed income assets across our retail and institutional portfolios, running multiple specialist fixed income strategies. The Interest and Income funds have slotted seamlessly into this well-established process.

The best description of our approach to fixed income investing is “holistic". Our fixed income process leverages the skills and experience of our entire investment team. We believe that viewing markets holistically provides valuable insight into a specific asset class, such as bonds. For instance, through our in-house equity research, we ensure that we fully understand the cash flows of a corporate, a bank, or a government, as well as the sustainability of those cash flows, before making the decision whether to lend that borrower money via a fixed interest investment. We believe this gives us a strategic analytical advantage in this space.

As with all Allan Gray funds, the positioning of the Interest and Income funds – including the percentage of each portfolio that is allocated across the various asset classes – is mainly driven by our bottom-up approach, drawing on our fundamental research process and capital allocation capabilities. Our fixed income processes focus not only on probability of issuer default, but also on expected loss given default, and we seek to manage position size prudently and avoid permanent loss of capital. Our research process also considers the medium- to long-term outlook for interest rates, which is influenced by our inflation outlook and expectations of the resulting South African Reserve Bank (SARB) policy response. Based on this analysis, we select securities for our funds. We generally take a conservative approach to managing our fixed income portfolios, balancing credit risk, duration risk and liquidity risk when selecting securities. In line with each portfolio’s objective, we aim to achieve the appropriate balance of risk and return.

Current positioning

The Interest Fund and the Income Fund were seeded on 1 May 2024, a time of heightened political uncertainty and increased market volatility in South Africa. In early June 2024, the local debt markets witnessed a sell-off after the African National Congress (ANC) lost its outright majority for the first time since 1994, creating uncertainty regarding potential coalition partners. During this period, there were good opportunities for the Interest and Income funds to lock in five-year fixed-rate cash exposures at a 10% yield, as well as opportunities for the Income Fund to look at structured fixed-rate instruments yielding 12%. The peak modified duration we ran during this period was 0.8 for the Interest Fund and 1.8 for the Income Fund, both a far cry from the type of interest rate sensitivity and volatility one can expect from traditional bond funds.

Following the local market sell-off, mid-June marked a pivotal moment for the country as the newly established government of national unity convened its inaugural parliamentary session and Cyril Ramaphosa was re-elected as president of the Republic. This development was widely embraced by financial markets, with the rand, the FTSE/JSE All Share Index and the bond market all experiencing substantial gains, signalling investor confidence in the potential for economic reforms and stability.

During the July Monetary Policy Committee (MPC) meeting, the SARB kept interest rates unchanged, citing that the battle against inflation is not yet won; overnight cash rates in South Africa remain at a 15-year high following the elevated inflation experienced over the last two years. The MPC prudently avoids giving forward guidance on interest rates so that they can remain nimble in the face of new data, although the market is pricing for rate cuts to begin as early as September 2024.

While the future remains uncertain, we aim to construct portfolios that can do well across a range of possible scenarios. We believe that the current Interest Fund and Income Fund portfolios hold assets that can provide above-cash returns and protect income in a high-inflation environment (particularly if interest rates remain higher than the prevailing inflation rate, as has been the case in South Africa over long periods). The funds also offer capital stability and minimise the risk of loss in highly uncertain environments.

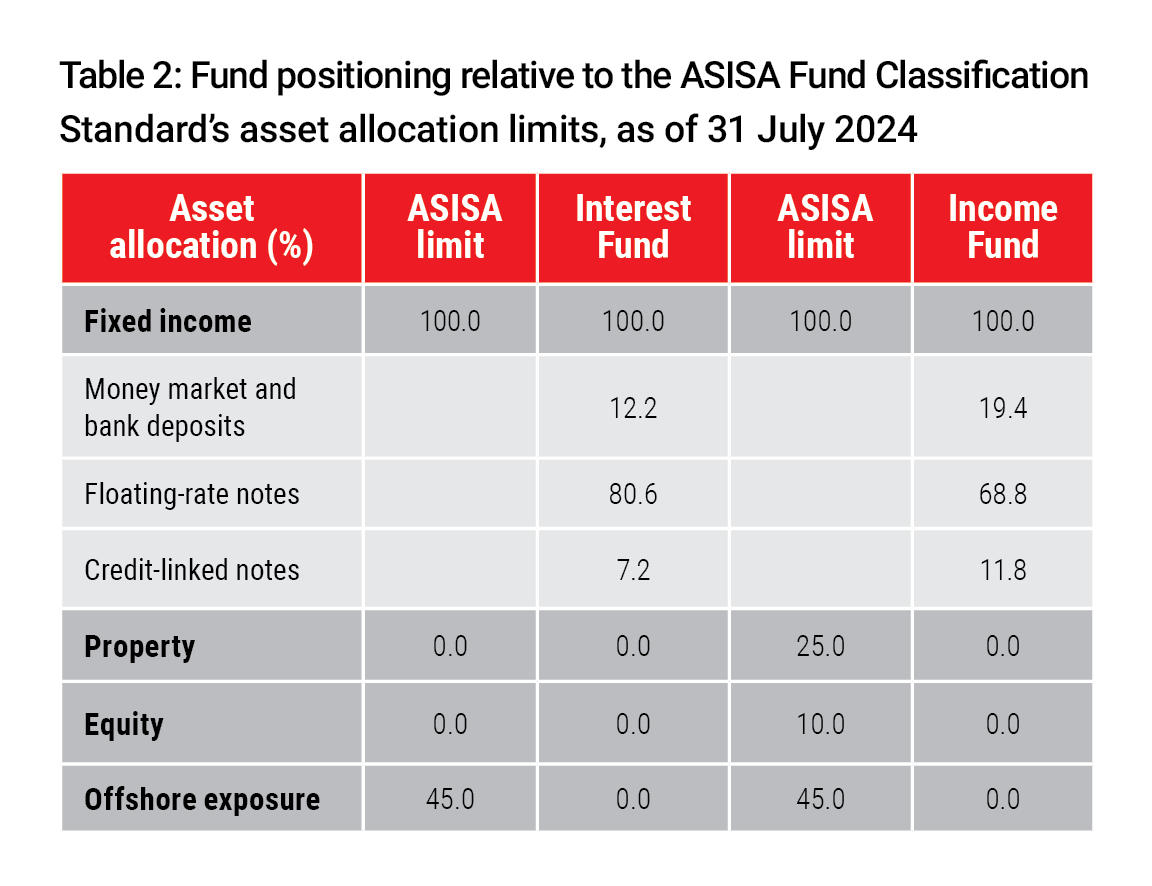

Since their inception, the Interest and Income funds have favoured floating-rate notes that return cash rates plus a spread and have low modified duration, as well as long-dated money market instruments, over traditional long-term fixed-rate bonds. Fund positioning as at the end of July is shown in Table 2.

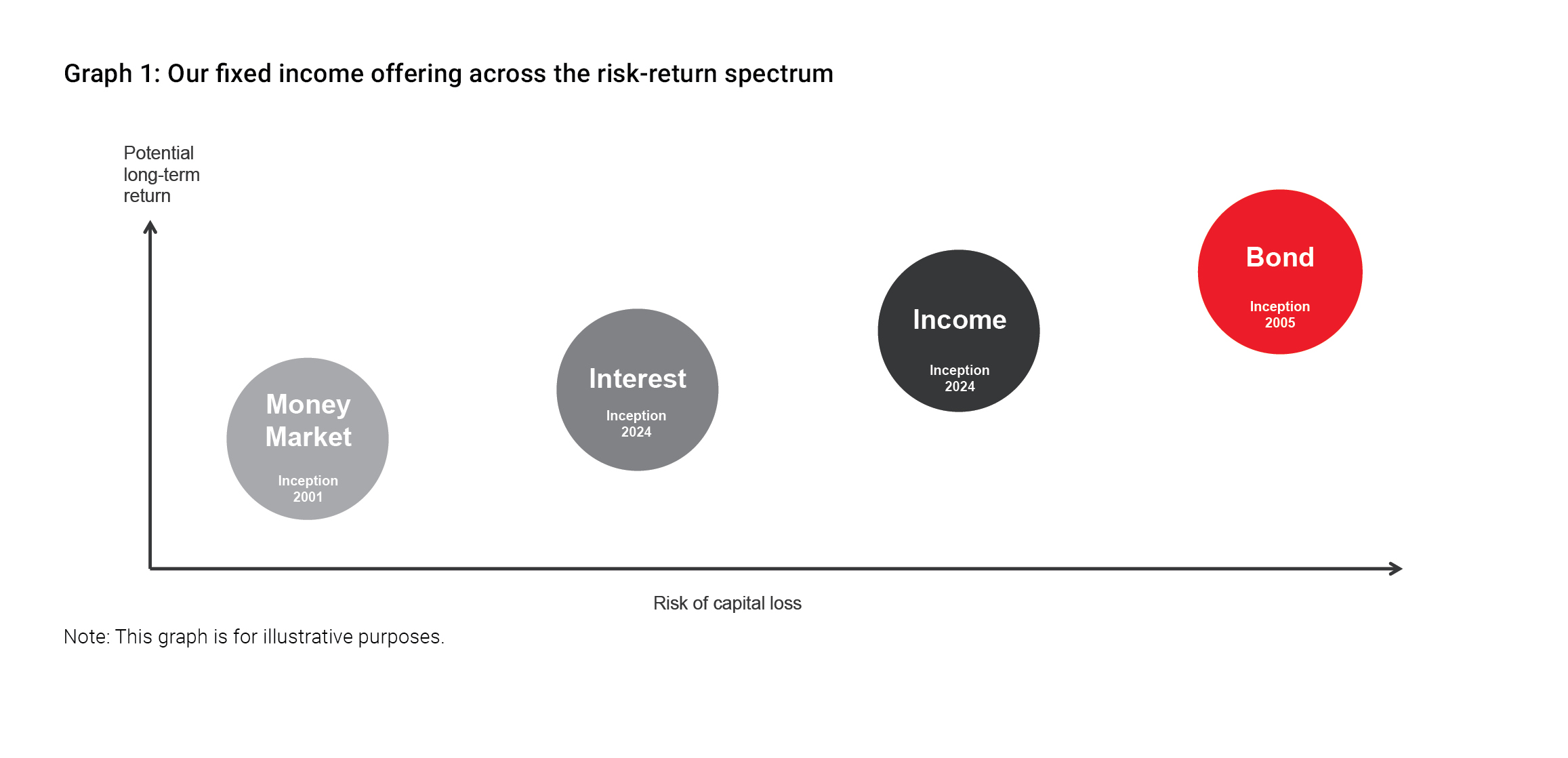

By combining our bottom-up process and our asset allocation views, the risk-and-return profile of the Interest and Income funds sits between that of our Money Market and Bond funds, as shown in Graph 1.

Considering each fund’s objective, our medium- to long-term interest rate outlook and the uncertainty in the current environment, we believe the current positions provide a cautious balance between capital protection, risk of loss and income generation. Over the long term, the mix of assets that will best fulfil each fund’s mandate is expected to evolve alongside available opportunities. What will remain constant, however, is Allan Gray’s focus on finding securities which offer an attractive real yield, issued by a creditworthy entity with a low risk of default, and from there building fixed income portfolios which balance capital protection, risk of loss and income generation.

For more information about the Interest and Income funds, please click here to view the latest fund factsheets.