Decision strategist and best-selling author Annie Duke advises focusing on a good process when trying to make the best decisions in highly uncertain scenarios. Jithen Pillay and Matthew Patterson look at the current environment and discuss how uncertainty influences investment outcomes.

Games can be categorised along a continuum based on their reliance on luck or skill. Roulette, for instance, is purely a game of chance. Despite occasional wins, the player will lose in the long run due to the wheel’s inherent design and the odds a player must accept. Conversely, chess is a game of skill, where a novice stands little chance against a grandmaster. While investing leans more towards the skill end of the spectrum, macroeconomic factors, geopolitical events and other unforeseen incidents introduce an element of chance into the equation, particularly over the short term.

Luck tends to emerge in uncertain environments. In the investment realm, luck can manifest as a favourable economic climate, an unexpected market-moving news event, or a timely market entry or exit. Put differently, luck can be good or bad and can present as a favourable or unfavourable hand of cards. However, luck is an external, unstable factor that we cannot control or replicate. To counter this, we need to focus on what we can control: the skilful application of a strong investment philosophy and process that has proven to work through various market cycles. This is a far more reliable determinant of success than luck over the long term.

Managing the hands we’ve been dealt

2024 is a year of heightened uncertainty, with the current hands we have been dealt requiring careful consideration. So, what are these hands, and how do we navigate them?

The first hand we have been dealt is an uncomfortable period of uncertainty following the outcome of our national elections. The decline in support for the ruling African National Congress (ANC) has ushered in an era of coalition politics at a national level. While this shift towards coalition politics can be seen as a sign of our democracy’s maturation, it also brings with it an element of unpredictability. The results of the ongoing negotiations could significantly reshape many policies, impacting companies in a variety of ways.

The next hand is the possibility of higher inflation and interest rates – especially in developed markets. Even though we are based at the tip of Africa and make investment decisions based on company fundamentals, macroeconomic factors in developed markets impact our investment environment. Drawing on the findings from Allianz Research and our offshore partner, Orbis, we need to be cognisant of the “five Ds” driving global inflation:

- Demographics: An ageing workforce and low unemployment are putting upward pressure on wages.

- Decarbonisation: The energy grid needs to transition to renewable energy; however, this requires significant capital investment.

- Deglobalisation: Supply chains are fragmenting as countries move away from using the most economical sources of production, to rather prioritise security of supply from domestic partners or economic allies.

- Debt: Heavily indebted individuals, businesses, and governments are generally more willing to tolerate high inflation as it reduces the real value of the debt. However, this could encourage them to take on more debt, further fuelling inflation.

- Defence spending: To maintain healthy democracies, countries realise they need to spend more on defence compared to recent history.

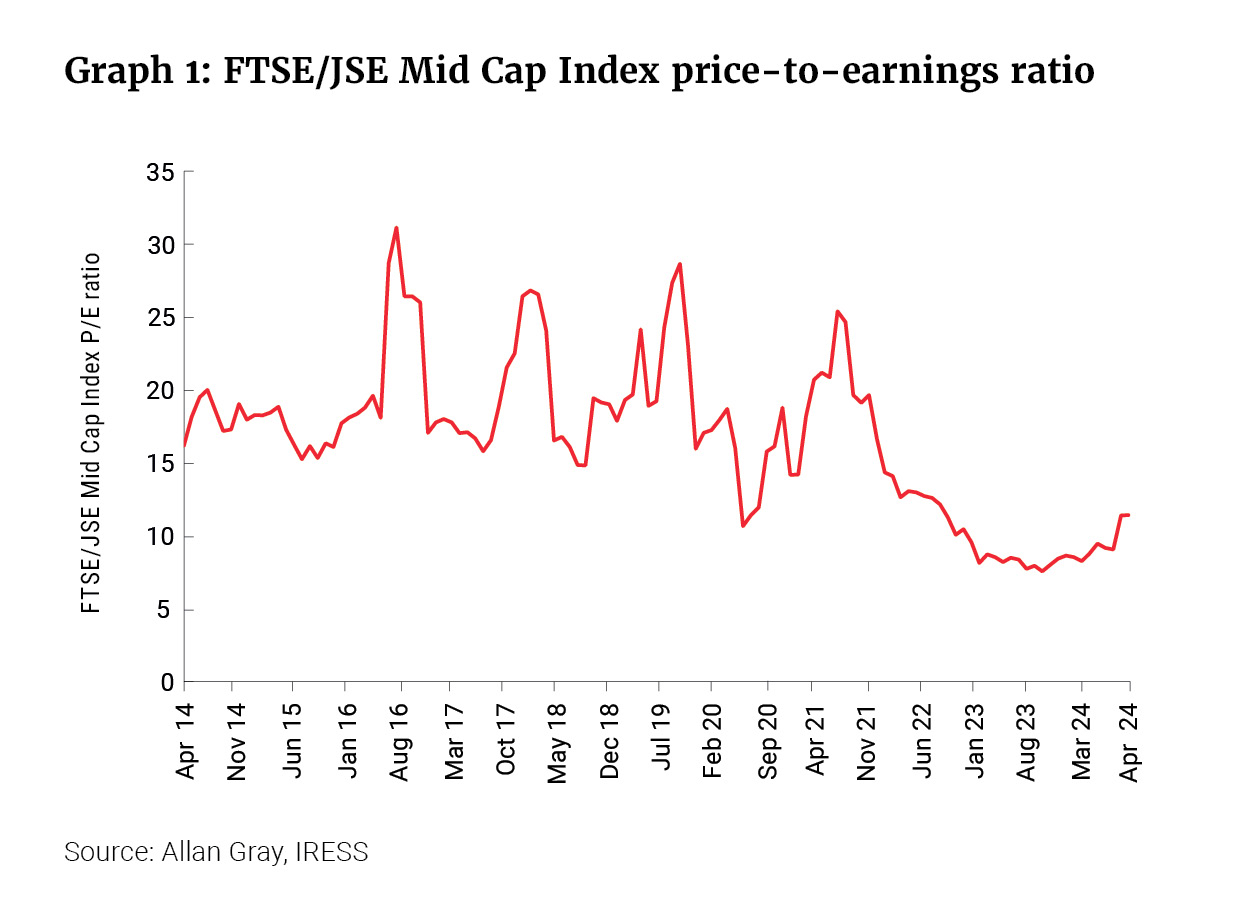

The third hand is a continued weak domestic economy. Many South African companies appear cheap on a headline level, as seen in Graph 1, which shows the price-to-earnings ratio of the FTSE/JSE Mid Cap Index – a proxy for companies mostly exposed to South Africa (SA). However, this comes with a health warning: The real earnings of these companies, on average, have struggled to grow over the last decade owing to sluggish revenue growth and rising costs (the latter particularly impacted by inefficiencies linked to loadshedding).

Positioned for a wide range of outcomes

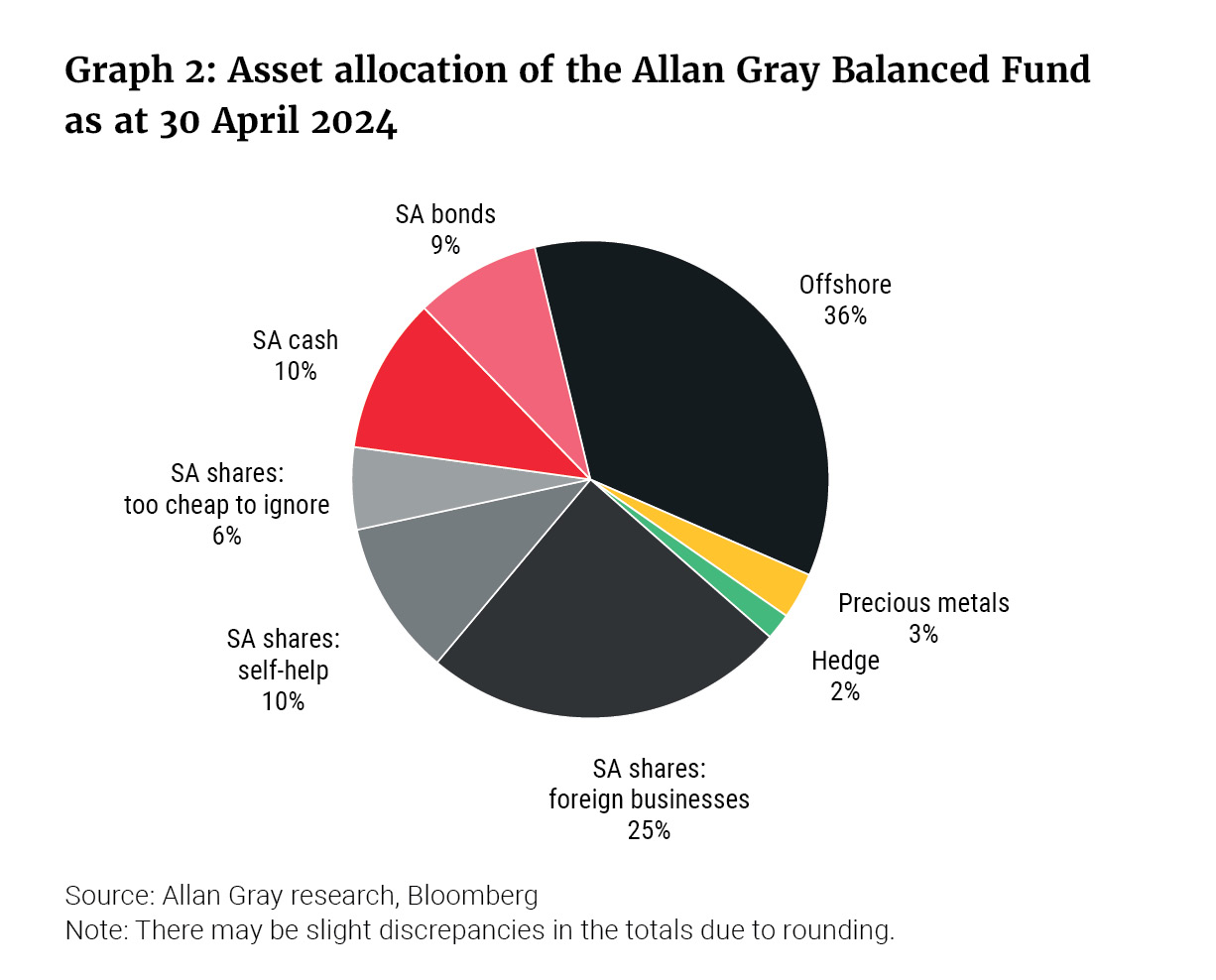

Given the heightened uncertainty and the hands that we have been dealt, which have the potential to deliver binary outcomes, we believe 2024 is a year to minimise risk and preserve capital. We have positioned our portfolios defensively for a wide range of potential outcomes – as shown in Graph 2, which uses the Allan Gray Balanced Fund’s positioning as an example.

The graph shows that just over one-third of the portfolio is invested directly offshore, and the lion’s share of this is managed by Orbis. One quarter of the portfolio is invested in local businesses with minimal exposure to the South African economy, such as packaging and paper group Mondi, British American Tobacco, and brewer AB InBev. We favour precious metals and select precious metal miners, as we believe they behave differently from the rest of the market in times of crisis.

We also favour SA “self-help” companies, which we believe have internal levers to pull to improve their economics, even if the local economy is weaker than we would have hoped. Examples here include Woolworths, Standard Bank, Remgro, and Tiger Brands. There are also a few SA companies we believe are too cheap to ignore, where things only need to go slightly better for investors to realise decent returns. However, selectivity is crucial, as not all companies in this category are likely to emerge as winners. A good example in this category is SA hospitality: an investor can buy the market value of the JSE’s entire listed hospitality sector for US$1.7bn – less than the price tag of a single US hotel, the Waldorf Astoria New York, which sold for nearly US$2bn in 2014.

Perhaps one of our most significant differentiators is our fixed income positioning, with a current preference for SA cash over SA government long bonds. At a 9% yield, the highest in 14 years, local cash today delivers a respectable real yield and provides optionality should buying opportunities present themselves.

We believe our positioning should protect client capital across various outcomes, as well as provide the opportunity to earn returns from a range of asset classes as different scenarios unfold.

As the year progresses, the cards will undoubtably be shuffled. We don't know whether the next hand will be equally challenging or deliver a royal flush. Regardless, we will continue to lean on the factors we can control – including the skilful application of our decades-old investment philosophy and process – which guides how we will respond, regardless of circumstance.