We are pleased to introduce the Orbis SICAV Global Cautious Fund, which, as Nshalati Hlungwane discusses, meets the needs of more conservative investors looking to balance investment returns and risk of loss while investing offshore. This low-equity, globally diversified, multi-asset class fund broadens the range of funds offered to South Africans by our offshore partner, Orbis.

Like Allan Gray, Orbis offers a focused range of funds. New funds are only introduced after careful consideration, and when we believe we can do a great job for clients and better enable them to meet their investment objectives. We have recently added the Orbis SICAV Global Cautious Fund (Global Cautious) to the Allan Gray Offshore Investment Platform.

Global Cautious is suitable for investors who seek US dollar returns with lower risk of capital loss and lower variability of returns than a pure equity or balanced mandate. It meets the needs of investors looking to invest in a diversified portfolio of securities, across asset classes and across countries. The Fund is managed in the same way as the other Orbis multi-asset class funds, using Orbis’ contrarian investment philosophy and bottom-up security selection process.

Global Cautious is suitable for investors who seek US dollar returns with lower risk of capital loss and lower variability of returns than a pure equity or balanced mandate.

How does Global Cautious fit in with the other Orbis funds?

For many years, Orbis has served clients with a small range of funds primarily split between a global fund that buys shares of companies around the world (the Orbis Global Equity Fund (Global Equity)) and a fund that invests across asset classes with a relatively high allocation to equities (the Orbis SICAV Global Balanced Fund (Global Balanced)).

Global Equity aims to earn higher returns than world stock markets, without greater risk of loss, while Global Balanced seeks to balance investment returns and risk of loss with a diversified global portfolio of equity, fixed income and commodity-linked investments. Both these funds have performed well for investors since their respective inception dates and remain suitable for those with a high tolerance for risk.

But what about investors looking for a lower-risk option?

This is where Global Cautious comes in, completing the set. Global Cautious can invest in the same asset classes as Global Balanced, but with materially lower exposure to riskier assets and a higher allocation to fixed income instruments. Simplistically, Global Cautious can be seen as the more risk averse “younger sibling” of Global Balanced. There are some securities in Global Balanced that will not be held in Global Cautious for risk reasons, just as there are some stocks in Global Equity that will not be held in Global Balanced. Graph 1 shows how the risk and return profiles of these funds stack up.

How Global Cautious invests

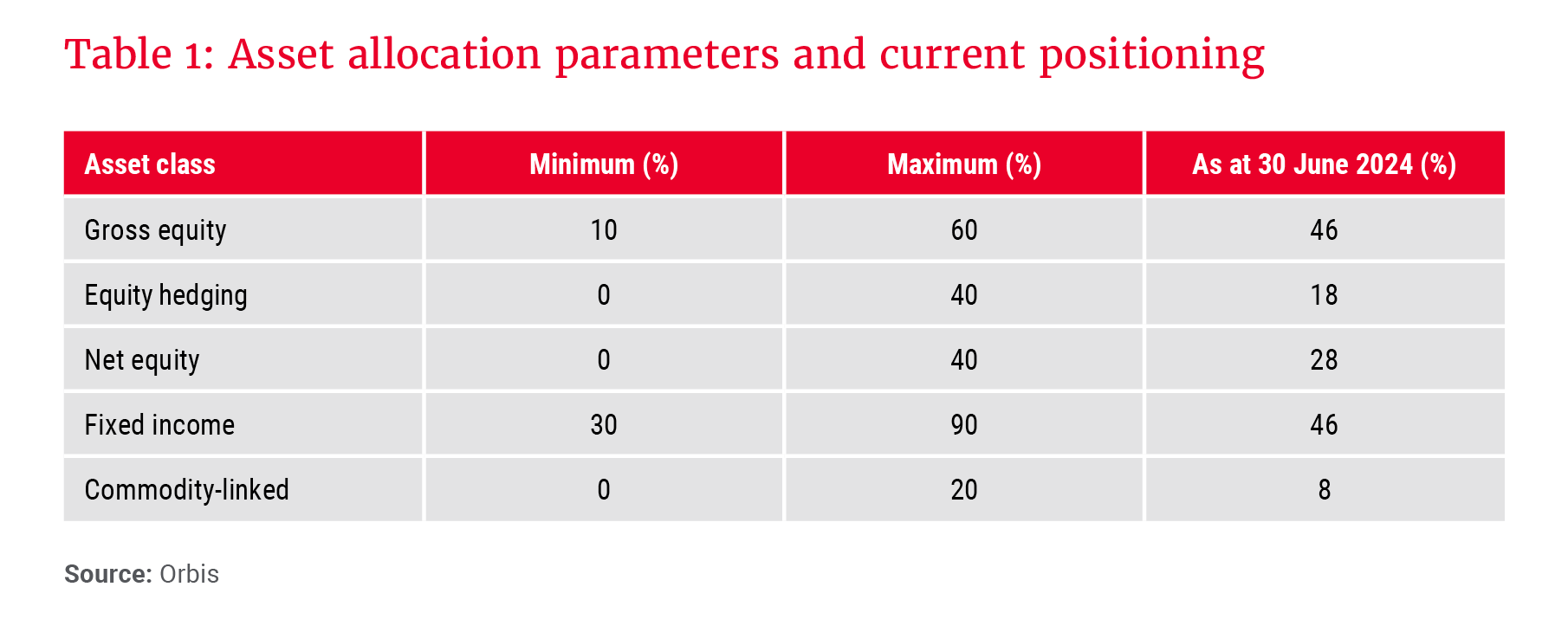

Global Cautious was initially launched in the UK market five years ago, and draws on the philosophy, process, tools and research of Orbis’ investment, currency and quantitative analysts worldwide. The Fund has been designed to allow for flexibility in exposure to different asset classes, as shown in Table 1. For instance, it can have a minimum of 10% and as much as 60% exposure to equities. Similarly, exposure to fixed income assets can be as low as 30% and as high as 90%. This helps ensure that Orbis delivers on the Fund’s objective over the long term and in different market environments. In addition to having exposure to equities and fixed income, the Fund can invest in commodity-linked instruments. It can also adjust its equity and currency exposures using hedging.

Like all Orbis funds, Global Cautious is built from the bottom up, with the risk and return characteristics of the various securities being compared with each other and competing for inclusion in the portfolio, as illustrated in Graph 2, as opposed to deciding the aggregate allocation to each asset class upfront and being forced to invest to meet that allocation. This is managed to achieve the appropriate balance of risk and reward, given the Fund’s objective.

Benchmark

The Fund’s performance fee benchmark is US dollar bank deposits plus 2%, which is an absolute benchmark, meaning it cannot generate a negative return. This also means that, irrespective of the market environment, the Fund can only charge performance fees when delivering positive returns in excess of US dollar bank deposits plus 2%. For investors with a lower risk tolerance, this aligns well with the Fund’s objective.

Fees

The performance fee structure comprises a base fee of 0.60% per annum plus 25% sharing in out-/underperformance. Unlike traditional performance fee structures, a unique feature of Orbis’ fee is the ability to refund investors for periods of underperformance. This means, if Orbis does well for investors, performance fees are charged but the whole amount is not immediately payable to Orbis – instead, a portion is reserved and allows Orbis to refund investors should a period of underperformance follow. Given the symmetrical nature of the fee, Orbis shares in both the upside and downside of performance and is focused on generating long-term outperformance for clients.

Performance

Although Global Cautious is lower-risk than Global Balanced, it is not risk-free, and returns have not been and will not come in a straight line. Since its inception in 2019, Global Cautious has navigated a volatile global market environment and delivered an annualised US dollar return of 3.9%. This compares favourably with the average of other global cautious funds and a low-equity index comprising 30% global equities and 70% global bonds, both of which have returned 2.8% per annum over the same period. However, it is lower than the Fund’s performance fee benchmark return of 4.5% per annum, as cash rates have increased globally over the past few years.

Looking ahead

As a valuation-focused stockpicker, Orbis is excited about the opportunities as there are many areas of the market that remain unpopular today, which is an ideal environment for Orbis’ investment approach and philosophy. Over the long term, the mix of assets that will best fulfil the Fund’s mandate is expected to evolve alongside the opportunity set.

While it is unclear what markets will do over the next 10, 20 or 50 years, with Global Cautious, Orbis continues to execute on its investment philosophy to find securities that trade at a discount to intrinsic value, and from there build a portfolio that balances capital appreciation, risk of loss and income generation for investors seeking a lower-risk fund.

For more information about the Orbis SICAV Global Cautious Fund, please see its factsheet.