Some weeks have passed since former Finance Minister Pravin Gordhan’s Budget speech, but we are only just beginning to feel the pinch. Carla Rossouw discusses how the tax increases impact you and offers some pointers on how to relieve some of the burden.

The 2017 Budget contained some surprises. Whether we like it or not, taxes aren’t optional and we have to rework our personal budgets to accommodate the changes. To recap, here’s a summary of the key take-outs:

- There was little increase in the tax brackets, leading to ‘bracket creep’.

- A new tax bracket was created for income above R1.5 million, with an income tax rate of 45%.

- Dividend withholding tax (DWT) was increased from 15% to 20%.

- The annual allowance for tax-free savings was increased from R30 000 to R33 000 per year.

But what does this all mean for you? Let’s take a look at each component.

Bracket creep impacts low- to middle-income earners

It was easy to misinterpret the Budget as having little impact on anyone other than the very wealthy. However, as you may have realised over the past month or so, a harsh silent tax increase has been imposed on the average South African tax-payer, resulting in less money in our pockets to save and spend.

Table 1 reflects the personal income tax rates for 2017/18. While personal taxes were not raised, individual tax brackets have only gone up by 1%, compared to inflation of approximately 6%. This means that if you received an inflationary salary increase, the purchasing power of your after-tax income will be lower due to the higher tax paid on this income (see the scenarios on page 13) and, as a result, you may come out poorer. This increase, which is also known as ‘bracket creep’, is likely to raise more than three times more money than the new tax on the wealthy (discussed later).

You may also feel the impact of bracket creep if you own a pension or living annuity and you increase your income by inflation.

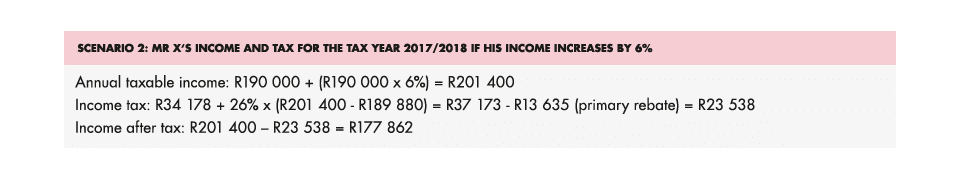

Although Mr X’s income has increased by 6%, his after-tax income has only increased by 5.2% due to bracket creep. This equates to a monthly reduction in purchasing power of around R119, which means that Mr X will be able to buy less with his after-tax income than he is currently able to buy.

You can use Graph 1 to work out your approximate monthly reduction in purchasing power. Simply look for your tax bracket along the bottom axis and then find the corresponding reduction on the left-hand side.

A new tax for high-income earners

For the highest earners (those earning above R1 500 000), the marginal tax rate has been increased from 41% to 45%. If you fall into this bracket your taxable income earned from investments will be taxed at the higher rate, resulting in reduced after-tax investment returns.

You will also pay more capital gains tax (CGT) if you withdraw from your unit trust investment. This is because CGT is collected at an effective rate which is a function of your marginal tax rate. The effective CGT rate for individuals in this top bracket increased from 16.4% to 18%.

Dividend withholding tax goes up

DWT is a tax collected from investors receiving dividends declared and paid by South African resident companies or foreign companies listed on the JSE. The increase in DWT affects the return on any discretionary investment that holds shares in either type of company. Dividend withholding tax was introduced in 2012 to replace secondary tax on companies. It affects the dividends portion of your investment’s overall return. The increase in the DWT rate will result in an additional 5% of a dividend being withheld and paid over to SARS. This means you will receive less in your pocket, or have less available for reinvestment.

Since it reduces the investment income that you receive, the increase in DWT will also impact the long-term returns on an investment. This is because a lower dividend reinvested today will have a compounded effect on returns in the future. This will result in a reduction in the growth of an investment over the long term.

The new DWT rate will have an impact on all discretionary investments that earn dividends including Allan Gray Unit Trust, Endowment and Investment Platform (local investments only) accounts. However, retirement funds, including the Allan Gray Retirement Annuity Fund and the Allan Gray Pension Preservation and Provident Preservation Funds, are exempt from income tax and from paying DWT and therefore your retirement fund investment will not be affected by the increase in DWT. Similarly your tax-free investment accounts are not impacted. Annuity income received from the Allan Gray Living Annuity is subject to income tax but not DWT.

How can you relieve some of the tax burden?

The annual limit for contributions to a tax-free investment account has increased by 10%. This product offers great shelter from the increases in the tax rates. While you invest with after-tax money, you can now invest up to R33 000 per year and pay no tax on your investment returns. The lifetime limit remains unchanged at R500 000. Additionally, saving in a retirement annuity, pension fund or provident fund allows you to reduce the amount of tax you pay from your salary and effectively have the government fund some of your retirement savings. This is because contributions to a retirement fund are tax deductible from your income. However, this comes at the cost of restricted access to your savings: you can mostly only access your money in these funds when you retire.

Lastly, an endowment has become an even more attractive choice. If you are a high earner looking to reduce your income tax and CGT liability you can do this using an endowment – provided you are prepared to tie your money up for five years. The life insurance company issuing the endowment pays (and deducts from policy holders) income tax at 30% and CGT at an effective rate of 12%.