The two-pot retirement system, which was implemented in September 2024, gives retirement fund members the ability to withdraw from the savings component of their retirement funds once per tax year. If you took advantage of this, it is important to work towards restoring your position. The end of the tax year in February provides an opportune time to do so. Carla Rossouw and Lee Kotze provide a brief reminder of the annual tax incentives that government has put in place to encourage investing towards long-term goals via retirement funds and tax-free investments and unpack some of the factors to consider when withdrawing from these products.

Your view of and behaviour related to your retirement investments may have changed following the introduction of the two-pot retirement system last year. As a reminder, most retirement fund members now have some access to their investments (through their savings component), intended to be used in case of financial distress when one would be worse off not withdrawing. (Visit the two-pot retirement system info hub for a reminder of the details.)

If you have made a withdrawal from the savings component of your retirement fund in the 2024/2025 tax year, it is a good idea to consider replenishing this amount before the end of the tax year in February to restore your position, taking comfort in the fact that you can access the savings component once per tax year, if need be. However, the fact that you can access your savings component once per tax year does not mean you should. Withdrawing should not be viewed as an annual event that must happen.

You can also consider contributing to a tax-free investment (TFI) to save for a specific goal or to supplement your retirement investment.

Before we delve into the factors that may affect your decision-making, it is worth reiterating exactly why retirement funds and TFIs are beneficial from a tax perspective.

Recapping the tax benefits of retirement funds and TFIs

Every year, you can make a pre-tax contribution to your retirement fund of up to 27.5% of your taxable income, capped at R350 000 per tax year. You forfeit this benefit if you do not make use of it each tax year. If you have not yet maximised your contributions for the current tax year, you can make an additional contribution, either in the form of a lump sum contribution to your retirement annuity (RA) or, if you are invested in your employer’s retirement fund, an additional voluntary contribution. You can also start an RA in your own name.

The other annual tax benefit the government offers is the ability to invest R36 000 per tax year (up to a maximum contribution of R500 000 over your lifetime) of after-tax money in a TFI.

Both retirement funds and TFIs benefit from growth free of any tax (including dividends tax, income tax on interest, and capital gains tax) while you are invested – a big win if you invest for the long term.

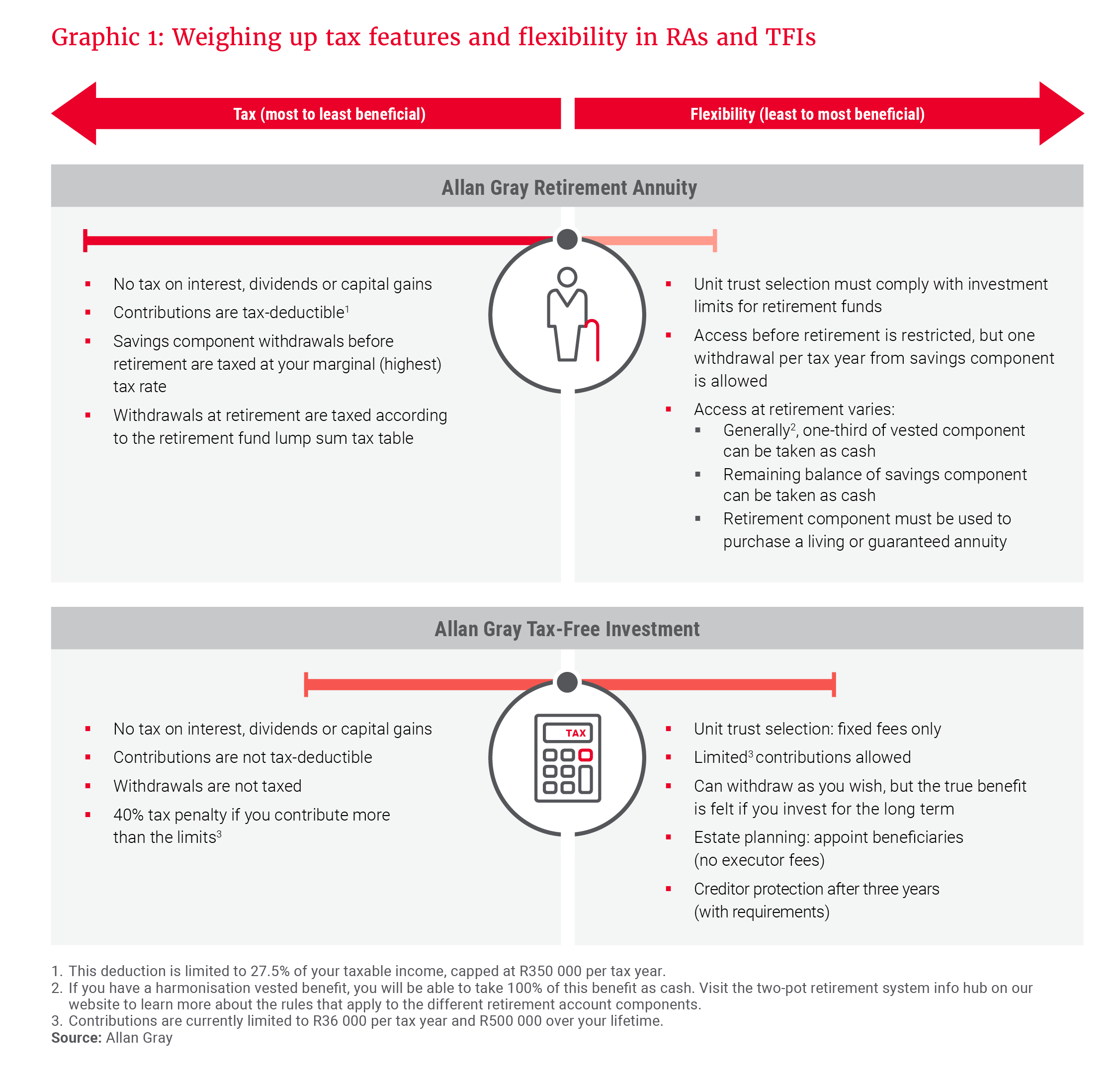

While both retirement funds and TFIs offer tax benefits, they each have unique features and restrictions. We have written about these extensively in previous years, and encourage you to read our previous tax pieces, available via the Latest insights section, to remind yourself of the details. Graphic 1 provides a summary of the tax features and flexibility RAs and TFIs offer.

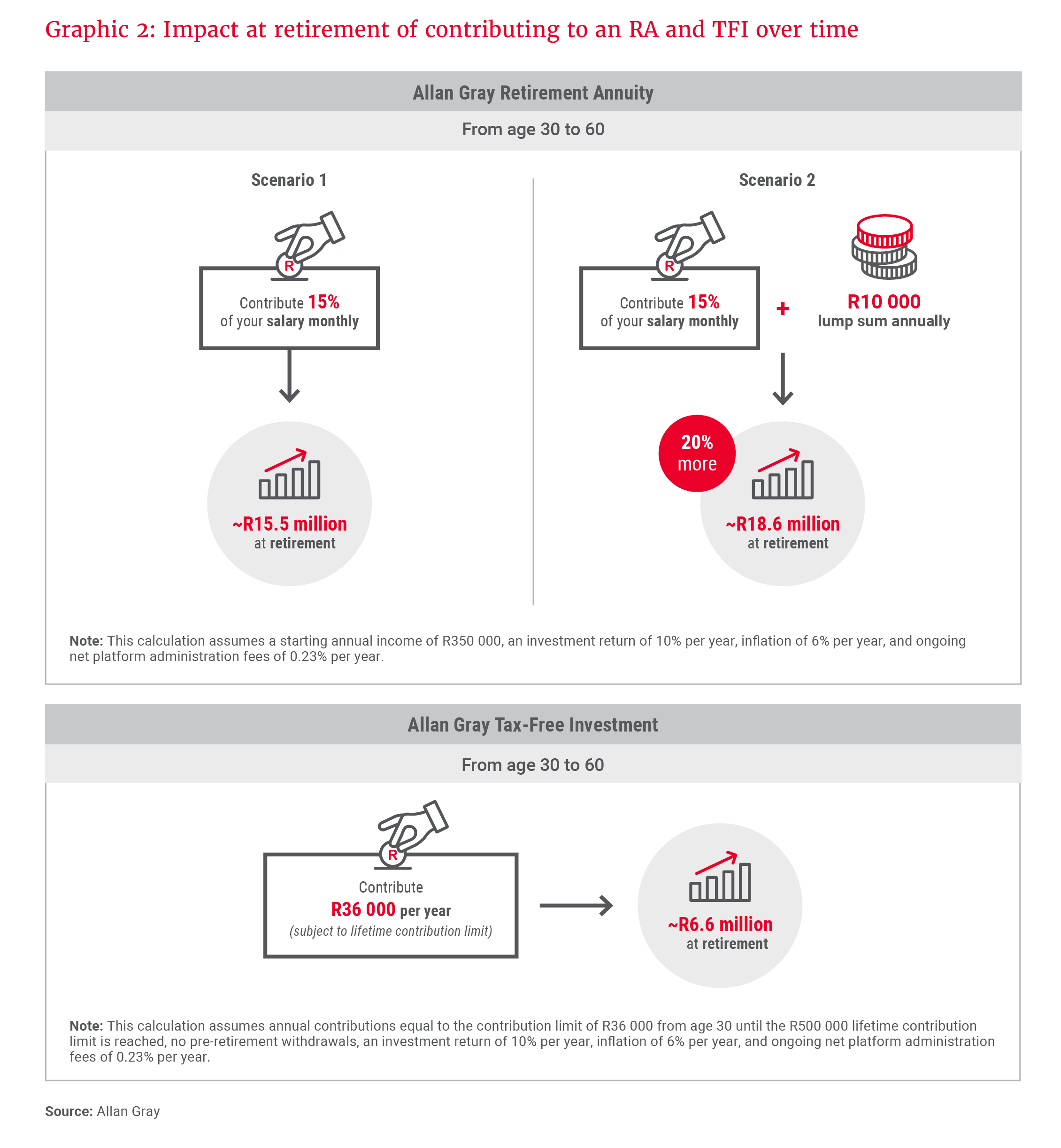

Graphic 2 illustrates the benefits of contributing to an RA and a TFI. For the RA, Scenario 1 shows what you can achieve by consistently investing for retirement over your working lifetime. Scenario 2 illustrates that, even if you are already contributing to an RA, you can benefit significantly by topping up your investment before the end of each tax year. The TFI example illustrates the benefits of maximising your TFI contributions each year until you reach the lifetime contribution limit, and then remaining invested until retirement.

Factors to consider if you need to withdraw

It is always a good idea to maximise tax benefits on offer – but even more so in a two-pot world, if you have withdrawn from your retirement fund along the way and want to restore your position and/or supplement your investments. It is important to familiarise yourself with the details around withdrawals so that you have the full picture and can understand what is needed to replenish your investments in the future.

Retirement fund withdrawals

In our Q3 2024 Allan Gray Quarterly Commentary article What you need to know about two-pot withdrawals and tax, we discussed some of the practical considerations before submitting a savings component withdrawal instruction for your retirement investment. Below, we highlight some of the important details.

- You pay tax on savings component withdrawals

Savings component withdrawals are taxed at your marginal tax rate. The tax due on your withdrawal will be withheld and paid over to the South African Revenue Service (SARS) and you will receive the after-tax amount. Any outstanding taxes that you owe SARS may also be deducted from your withdrawal prior to the benefit being paid to you. This means you may receive less than the amount that you withdraw. For example, if you need R20 000 because of an unforeseen financial emergency and your marginal tax rate is 36%, you will need to withdraw R31 250, since R11 250 will be withheld as tax and paid to SARS (assuming you have no outstanding amounts owed to SARS).

- Withdrawing before retirement reduces the amount available as cash at retirement

A further important consideration is that the balance in your savings component is generally all you will be able to withdraw as cash at retirement. (Your retirement fund investments made before two-pot are treated differently.) You cannot access any portion of your retirement component as cash – the full amount of the retirement component must be used to purchase a retirement income product, such as a living annuity or a guaranteed annuity.

If you think you will need access to cash from your retirement fund at retirement, for example to pay off your home loan, you will need to ensure you have the required amount available in your savings component. This is why replenishing withdrawals could be a good option, but note the next point.

- Replacement contributions are split between components

If you want to replace the amount withdrawn in the future, it is important to be aware of how these future contributions will be treated. Continuing with the previous example, if you make an additional contribution of R31 250 to replace the amount you withdrew, two-thirds of that additional contribution will be allocated to your retirement component and one-third to your savings component. This means that only R10 416 will be invested in the savings component, compared to the R31 250 you withdrew. This may have significant implications for you if you need access to cash at retirement.

To reinstate the total value of your savings component, you will need to contribute R93 750, one-third of which (i.e. R31 250) will be allocated to your savings component. You also lose out on any investment growth between the date of withdrawal and the date you replace the amount withdrawn.

If you have already contributed your maximum tax-free amount, you will get the tax benefit from your additional contribution at a later stage. Your extra, after-tax (non-deductible) contributions (excess contributions) can benefit you throughout your lifetime: They can be carried over and deducted in the next year, and they continue to be carried over until they are fully utilised – so the benefit is never lost, as discussed in our Q4 2023 Allan Gray Quarterly Commentary.

TFI withdrawals

- TFI withdrawals are not restricted

There are no restrictions on TFI withdrawals, and withdrawals from TFIs are not taxed. This means that you can withdraw whenever you want to and the amount you withdraw will be the amount you receive. It is therefore tax-efficient to withdraw from your TFI, but there are implications – discussed in the next point.

- Withdrawals cannot be replaced

TFIs have a lifetime contribution limit of R500 000. The amount you have contributed is not reduced by withdrawals you make and these cannot be replaced. For example, if you have contributed R200 000 to your TFI to date, you have R300 000 left to contribute before you exceed the lifetime contribution limit. (You pay a SARS penalty of 40% on any contribution above the annual and lifetime limits.) If you decide to withdraw R20 000 from your TFI, you will still only be able to contribute an additional R300 000 over the remainder of your lifetime.

As mentioned earlier, you do not pay tax on interest, dividends or capital gains while invested in a TFI; you therefore benefit from tax-free growth. If you typically use the interest and capital gains tax exemptions each year, this tax-free growth is a very valuable benefit, which increases in value the longer you remain invested, and you will be foregoing this benefit on any amount withdrawn from your TFI.

Weigh up your options and seek professional advice

If you face circumstances where you need to withdraw from either your retirement fund or TFI, it makes sense to bear tax efficiency in mind. However, depending on your personal situation, there may be additional important factors to consider, including your remaining investment time horizon, and whether you have previously withdrawn from your retirement fund. Financial advice may help you to make an informed decision.

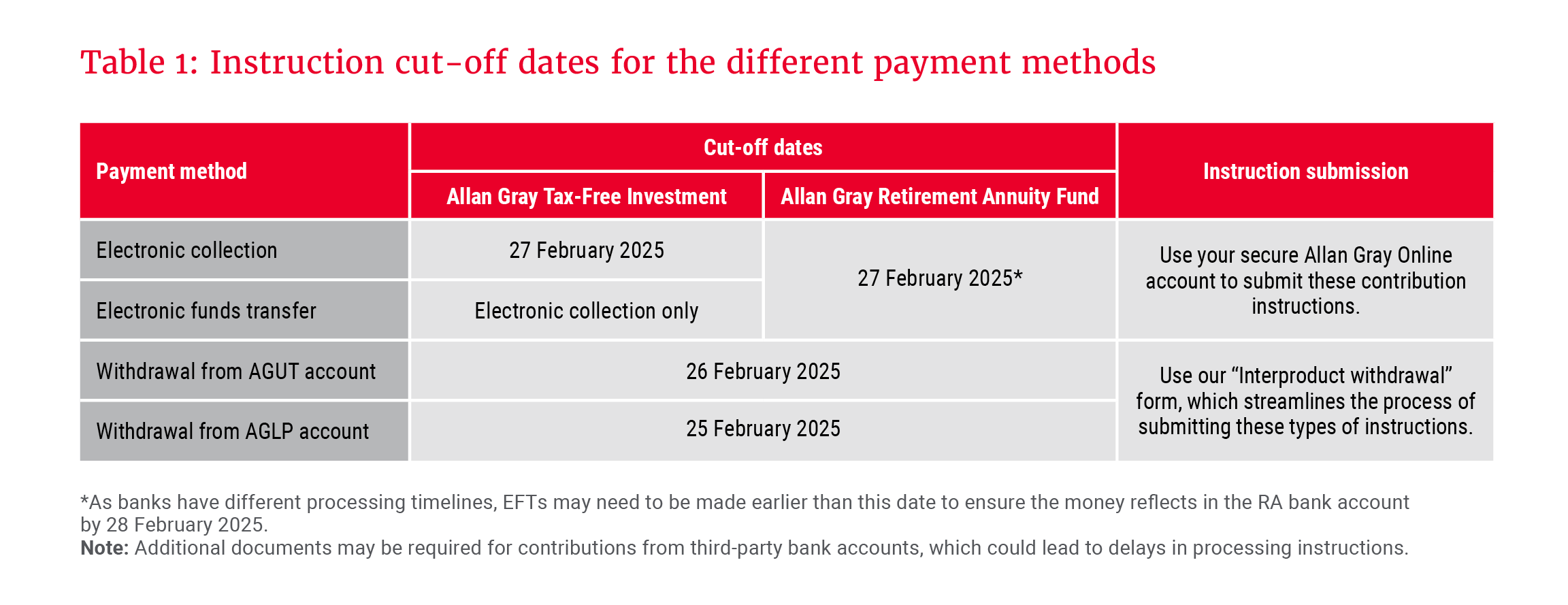

If you are planning to make use of the tax concessions for the 2024/2025 tax year by starting a new RA or TFI, or by making an additional contribution to an existing account, please ensure we receive your instruction, supporting documents and payment well in advance of the deadlines shown in Table 1.

Explore more insights from our Q4 2024 Quarterly Commentary:

- 2024 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Paying tribute to Gillian Gray by Craig Bodenstab

- Diamonds in the rough: A look at luxury by Jithen Pillay

- Where investors fear to fish by Rory Kutisker-Jacobson

- Orbis: President’s letter 2024 by Adam R. Karr

- In safe hands with the Allan Gray Balanced Fund by Nick Curtin

- How to keep the lid on lifestyle creep by Twanji Kalula

To view our latest Quarterly Commentary or browse previous editions, click here.