With the highly anticipated 2024 Olympic Games in Paris on the horizon, all eyes are on the dedicated athletes who have spent their lives chasing gold. Their stories of resilience, discipline and strategic thinking offer invaluable lessons not only for aspiring sports champions, but also for investors. Belinda Carbutt explores the parallels between pursuing Olympic glory and the journey to financial independence.

The road to Olympic glory: A marathon, not a sprint

Olympic athletes dedicate years, and sometimes decades, to training for a few moments of competition. Their journey is marked by countless hours of preparation, relentless dedication and an unwavering focus on their ultimate goal. This long-term commitment is essential for reaching the pinnacle of their sport.

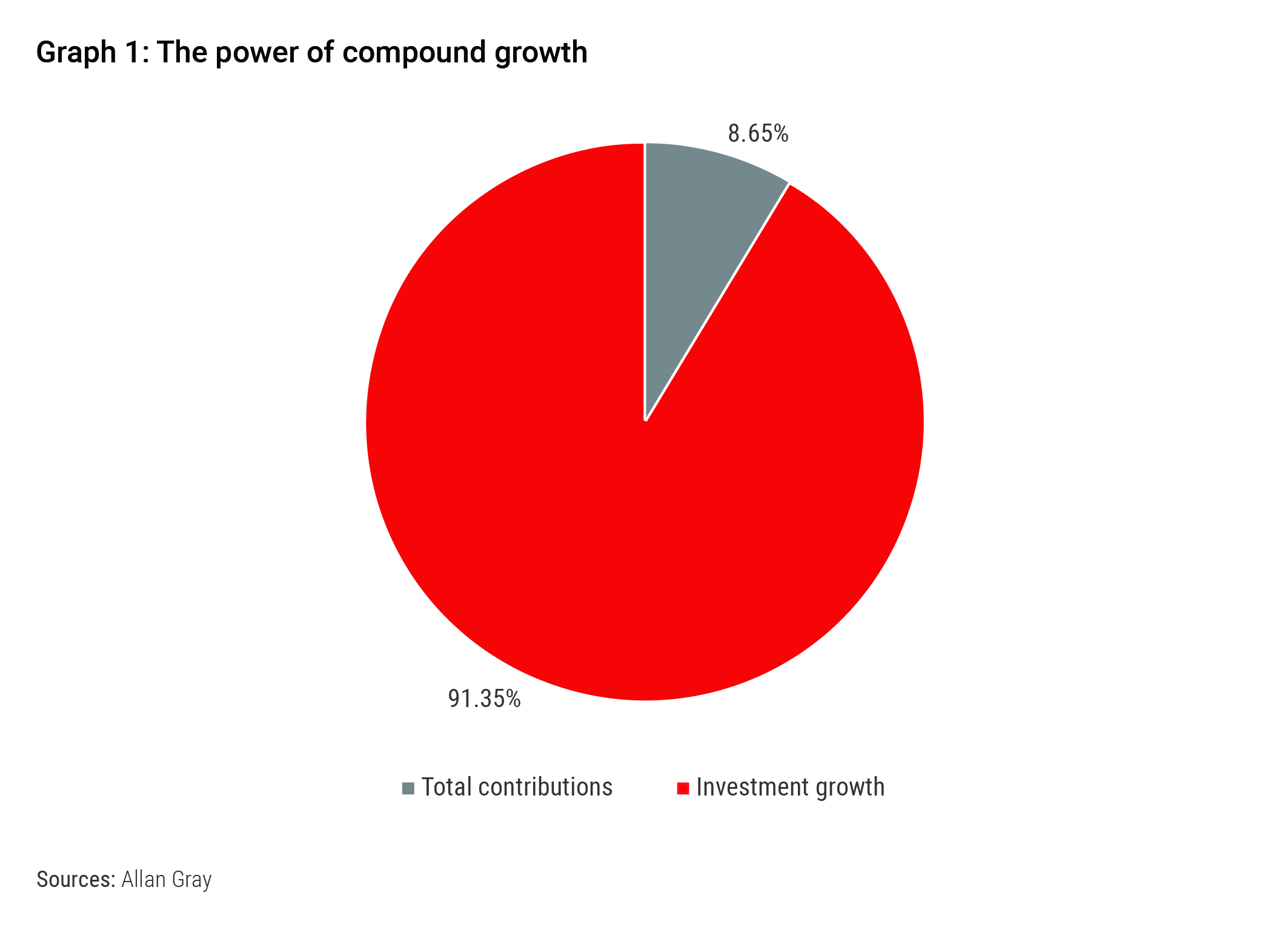

In the world of investing, a similar long-term approach is crucial. Achieving financial independence and having enough saved for retirement requires years of consistent investing. The concept of compound interest, which allows investments to grow exponentially over time, can be compared to the cumulative effect of an athlete's training. Just as an athlete's performance improves gradually through persistent effort, an investor's wealth builds slowly but surely through disciplined contributions and prudent investment choices.

Graph 1 illustrates this point. If you started investing for retirement at the age of 25, contributing R1 000 a month until you reached retirement age, you would have R5 550 348 by 65 (assuming 10% annual return). The remarkable story here is that 91.4% of your final sum would come from compounding, which means you would have only contributed R480 000 over four decades to reach the total amount.

Discipline: The foundation of success

Discipline is a defining characteristic of Olympic athletes. They adhere to strict training regimens, maintain rigorous diets and often sacrifice short-term pleasures in pursuit of their long-term objectives. This discipline ensures they are in peak physical and mental condition when it matters most.

As an investor, discipline reveals itself in the form of adhering to a budget, creating an investment strategy and sticking to your goals. Consistently saving a portion of your income and resisting the urge to make impulsive spending decisions demonstrates a similar kind of rigour. It may be tempting to deviate from your investment strategy during market volatility and times of economic uncertainty, but those who stay the course are more likely to achieve their financial goals. Just as an athlete cannot afford to skip training sessions or indulge in unhealthy habits, an investor cannot afford to neglect their budget and investing strategies.

Visualisation: The winning mindset

Top athletes use visualisation to mentally prepare for their performances. They envision themselves succeeding, whether it is crossing the finish line first or executing a flawless routine. This mental rehearsal helps build confidence, reduce anxiety and enhance performance.

Investors, too, can harness the power of visualisation by clearly defining their financial goals and regularly envisioning their desired future. Whether it is imagining your future self owning your dream home, funding your child's education, or enjoying a comfortable retirement, having a vivid picture in your mind can serve as motivation. Visualisation can help you remain focused on your long-term objectives, making it easier to navigate short-term challenges and stay committed to your investment plans.

Seek professional guidance: The coach on your side

Just as athletes work with coaches, it is wise to consider seeking financial advice. An athlete's training programme is tailored specifically to their needs; your financial plan and investment strategy should be customised for you. Athletes experience both good and bad days during training and competition, and it is during these times that a coach motivates and encourages them to stay focused. A good, independent financial adviser can help you stay motivated and get back on track when life inevitably happens and you deviate from your plan.

Let the games begin

As the Olympic Games in Paris draw near, let the dedication and triumphs of athletes inspire you to navigate the path to the podium of financial independence. Just as athletes achieve greatness through perseverance and strategic planning, you too can achieve investment success through discipline and commitment.