First published in October 2023.

Big changes to the South African retirement system are coming, which may change how you interact with your retirement savings – including the ability to access a portion of your investment in an emergency.* In part 3 of our Two-pot chapter, Jaya Leibowitz reminds us not to lose sight of the importance of preserving retirement savings, and cautions investors against dipping into these funds unnecessarily.

Commonly referred to as the “two-pot system”, the new rules applicable to retirement funds, set to launch on 1 September 2024, will require all future contributions made to retirement funds, including the Allan Gray Retirement Annuity Fund and the Allan Gray Umbrella Retirement Fund, to be split into two portions: two-thirds of your contribution will be allocated to a retirement component, which must be preserved until you retire, while the remaining one-third will be allocated to a savings component, from which you will be able to withdraw once per tax year prior to your retirement (referred to as a “savings withdrawal benefit”). The withdrawal amount will be limited to the value in the savings component at the date of withdrawal. (For more detail on the basics of the two-pot system, please refer to The two-pot system – what we know for now.)

The main idea behind this new system is to promote the preservation of retirement fund savings until retirement, while also providing retirement fund members with some access to their savings in times of need before they reach their retirement age.

The amendments to legislation require that, when the new system is implemented, a portion of the savings in a member’s existing retirement fund account, amounting to the lesser of 10% or R30 000, must be allocated to their savings component. This means that existing members who need access to cash will be able to access a savings withdrawal benefit shortly after implementation.

While access to one savings withdrawal benefit per year may come as a welcome relief to many who genuinely need it, if you are able to, you should rather use (or set up) a separate emergency fund for this purpose (refer to Consider setting up an emergency fund below), and do what you can to preserve your retirement investment for its intended purpose: to provide you with an income in retirement.

Immediate impact of accessing a savings withdrawal benefit

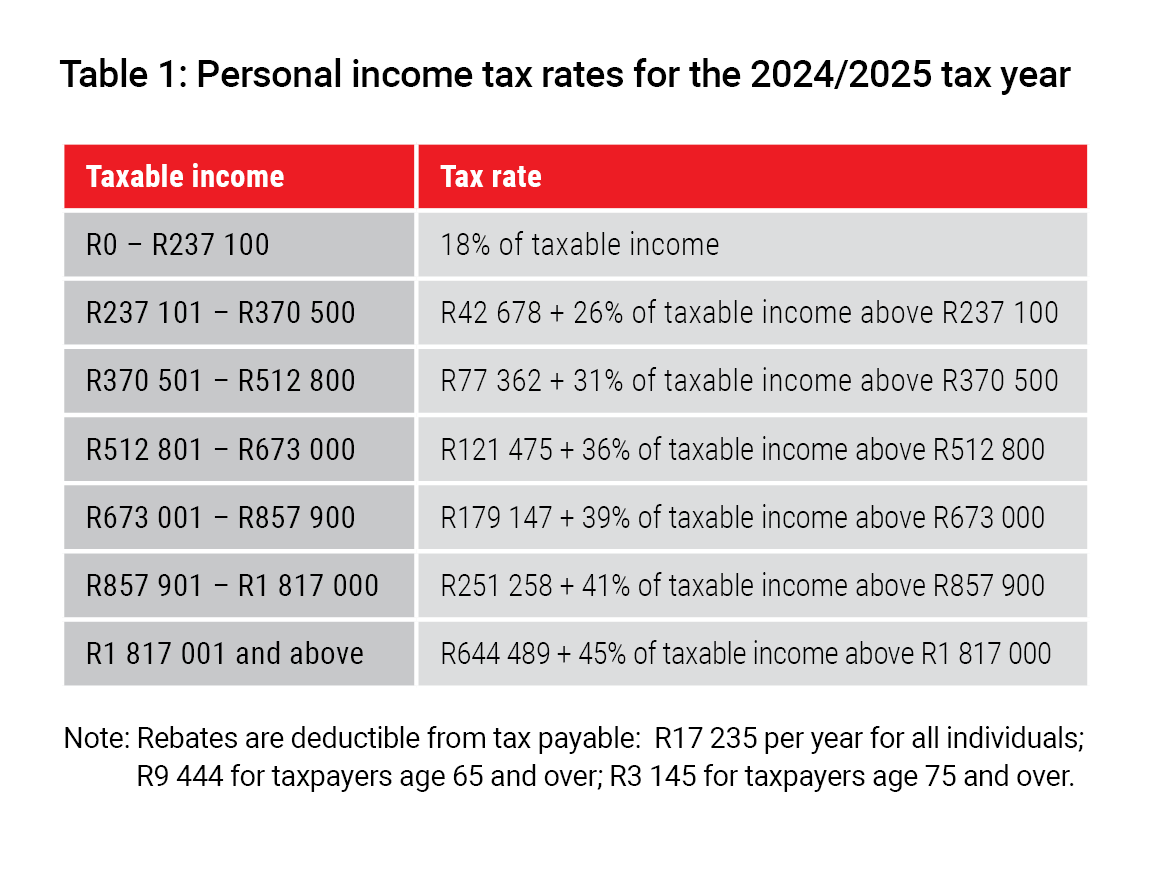

In terms of the new legislation, a savings withdrawal benefit will be included in the member’s gross income for the tax year in which that benefit was accessed. This means that the amount withdrawn will be taxed at the member’s marginal tax rate. If you are unemployed and have no income in the year of the withdrawal, you would be able to withdraw up to R95 750 from your savings component tax-free (this is the tax threshold for South African tax residents under the age of 65). As mentioned above, the maximum amount available for a savings withdrawal benefit will be the amount that has accumulated in the savings component (contributions plus growth, less any costs) at the date of the withdrawal. However, if you are earning, it is important to understand that because it is included in gross income, the withdrawal amount could push you into a higher tax bracket. This tax treatment aims to discourage individuals from accessing a savings withdrawal benefit when they have other sources of income and don’t really need to dip into their retirement fund savings.

By way of example: Sally is a 35-year-old full-time employee with a taxable income of R370 000. Based on the 2024/2025 income tax table (see Table 1), her tax liability will amount to R59 997 (R42 678 + 26% of the amount above R237 100 – primary rebate of R17 235). If Sally decides to access a savings withdrawal benefit of R25 000, she will be pushed into a higher tax bracket and will be liable for tax of R67 722 (R77 362 + 31% of the amount above R370 500 - primary rebate of R17 235).

Long-term impact of accessing a savings withdrawal benefit

Accessing a savings withdrawal benefit at any time prior to retirement may have a far bigger impact than you realise. If you are young, you may think that you will have plenty of time to save the amount that you have withdrawn, but not preserving that investment will cost you more than you may think as you will miss out on the power of compounding. Often referred to as the “eighth wonder of the world”, compounding means you earn returns today on the returns you earned yesterday, over and above the amounts of money you contribute.

If, for example, you plan to retire at age 65 and decide to take a savings withdrawal benefit of R50 000 at the age of 35 to spend on a holiday or a few months of fun, you could lose out on up to R870 000 that would have been used to provide you with an income during retirement. That’s a big difference. (Total investment growth assumed is 10% per year for 30 years – inflation at 6% plus 4% – and the investment is assumed to grow at a steady rate; no volatility is taken into account).

Emergency withdrawals

Despite the above, there may be urgent reasons why a member of a retirement fund who does not have an emergency fund may need to access their savings withdrawal benefit – such as to pay for medical expenses, pay off outstanding debt or fund basic living costs during a time of unemployment. Before going ahead with a withdrawal, consider the questions below and talk to your independent financial adviser:

- Do you really need the withdrawal amount to pay for something important? If yes, do you need the full amount or could you reduce it?

- What is your marginal tax rate likely to be in the year of the withdrawal and how might the withdrawal amount impact your overall tax liability?

- How much tax are you likely to pay on the withdrawal itself?

- How is the withdrawal likely to impact your long-term savings towards retirement?

Staying invested is key

Wherever possible, retirement fund members should avoid accessing their savings withdrawal benefit. If you have another source of capital and/or income and do not have essential expenses that you would not otherwise be able to afford, always maintain your investment in your retirement fund. Staying the course will significantly impact the amount of money you will have to provide you with an income during your retirement.

An emergency fund provides you with access to money and prevents you from abandoning your long-term financial plans when unexpected expenses or emergencies threaten to compromise your financial health.

If you don’t already have an emergency fund, consider directing some of your savings into an investment vehicle that aims to preserve your capital over the short term. You should aim to accumulate three to six months’ worth of your salary for emergency purposes and this investment should also be easily accessible.

Your emergency fund could be parked in a low-risk investment, such as a money market unit trust, which aims to deliver higher returns than a bank deposit, and can be accessed in a short space of time if disaster strikes. While contributions are not tax-deductible and you may be liable for tax on interest and capital growth (if any), no tax will be deducted from a withdrawal from these accounts – unlike a withdrawal from your retirement fund, which has significant consequences, both at the time of the withdrawal and over the long term.

If you need assistance in setting up an emergency fund, consider talking to a good, independent financial adviser.

This article is part of our Two-pot chapter. You can access the full series here.

Visit this page to learn more about the two-pot retirement system.