First published in August 2024

For a long time, the retirement savings industry has observed how many South Africans have struggled to balance accumulating and preserving their long-term retirement savings with the need for access to funds in difficult times. In too many cases, members of retirement funds have resorted to resigning from their jobs as a desperate measure to access their pension and provident funds; many others have opted not to preserve their retirement savings when changing jobs. The unfortunate consequence has been a burgeoning number of South Africans with insufficient retirement savings. Tebogo Marite discusses why building up an emergency fund should be prioritised even though the two-pot retirement system allows some access to retirement savings.

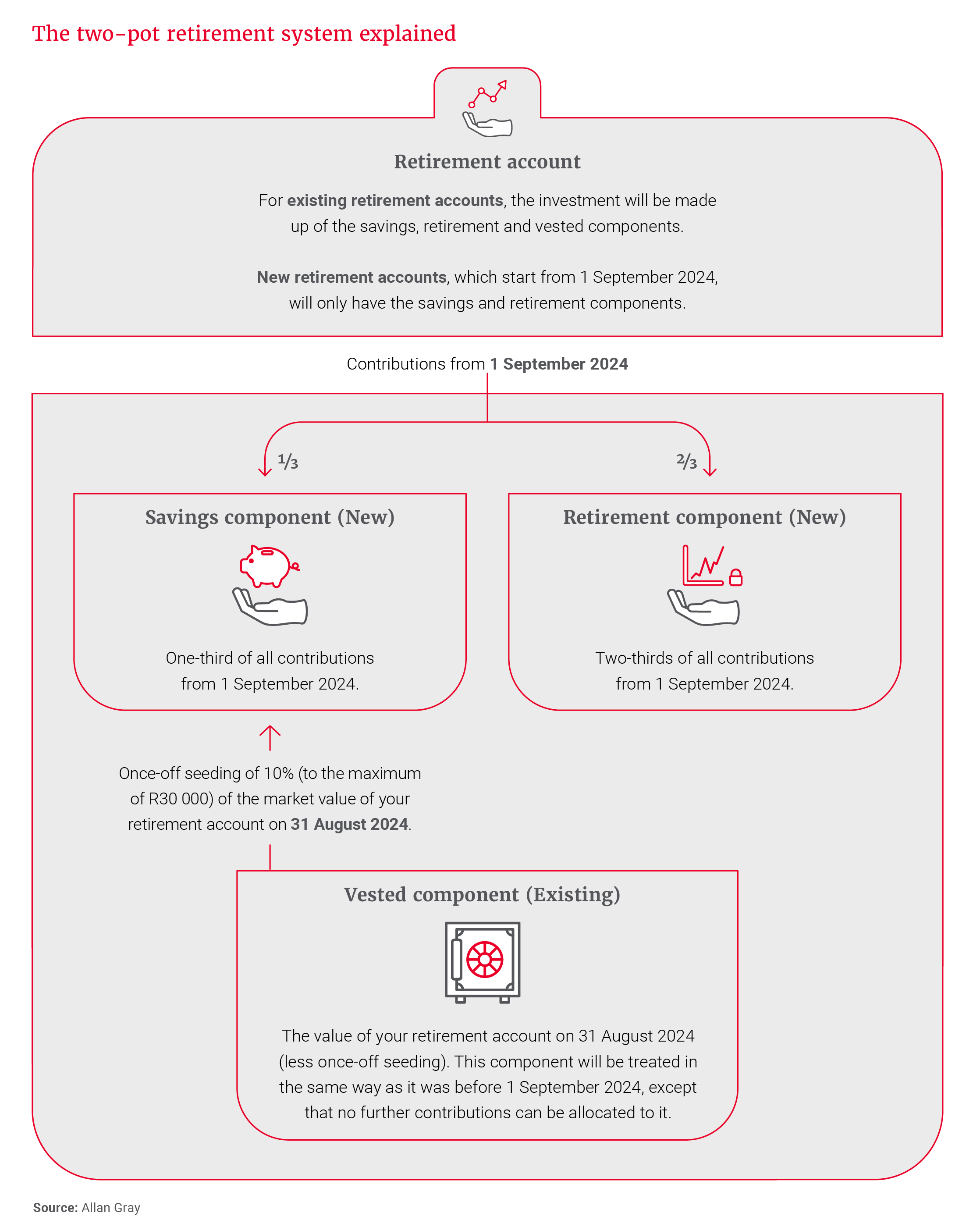

The two-pot retirement system, which was implemented on 1 September 2024, aims to combat both immediate and long-term hardship by allowing limited access to retirement funds, while enforcing preservation, with the aim of improving retirement outcomes. As shown in the graphic below, from the implementation date, all contributions to retirement funds are split into two components: One-third of contributions are allocated to a savings component, which members can access once a year before retirement, and the remaining two-thirds are allocated to a retirement component, which is inaccessible before a member retires, and at retirement must be used to purchase a retirement income product. Any accumulated retirement investments up until 31 August 2024 (less an initial once-off amount transferred to seed the savings component) have been placed in a vested component, and the fund rules that applied on that date will continue to apply. (For more detail, see Shaun Duddy's piece, which discusses how the new rules aim to improve outcomes and the risks that need to be avoided to achieve this, and Lydia Fourie’s article, which addresses frequently asked questions.)

By … making a concerted effort to build up emergency reserves … you can preserve your long-term investments for their intended purpose ...

While access to the savings component may provide welcome relief to those in dire need, as a retirement fund member, it is vital to be mindful of the unintended consequence of unnecessary early access, which can prevent you from reaching your long-term investment goals. Your retirement savings are intended for a very specific purpose: funding your income in retirement. Despite getting access to a component for emergencies, it is important to guard against thinking of your savings component as your emergency fund. Depleting your savings component annually will result in you having one-third less on which to retire.

An emergency fund is insurance for you – and for your long-term financial goals

Deciding how to allocate your money to various goals can be complex and requires trade-offs between current and future lifestyle wants and needs. Typically, an investment plan includes different investment products to meet a range of objectives. Using the products as intended and appreciating the time frames required for success are important aspects of long-term wealth creation. A good, independent financial adviser can help you with these decisions.

Beyond membership of your employer’s retirement fund, which is often not an active decision but a condition of employment, a critical starting point is to protect yourself against the risk of unknowns by building up an emergency fund.

How to set up an emergency fund

Aim to accumulate at least three times your monthly salary. This should be invested in a low-risk unit trust, such as a money market fund, which will preserve your capital over the short term and offer easy access when needed. Accumulating a healthy emergency fund may take some effort, including lifestyle adjustments, such as paying off expensive credit card debt and sticking to a monthly budget. Commit to “paying yourself first” and then set up a debit order so you don’t have to battle old habits each month.

For example, if you earn R25 000 per month after tax and other deductions and want to build up three months of reserves, you will need to set aside R4 167 per month for 18 months to accumulate R75 000. By the time your emergency fund is established, you will be used to the monthly sacrifice.

Rather than reverting to your previous spending habits, redirect your monthly payments into a longer-term investment (and remember to increase your contributions in line with your salary increases to account for lifestyle inflation). This way, you continue with the new habit, which builds your investment resilience. If you do have an emergency and need to spend some of the emergency fund, you can then easily redirect your debit order until you have replenished the spend.

Ultimately, you should aim for your emergency fund to be sufficiently sized to buy you enough time to manage and recover from a crisis without the need to dip into your long-term investments. It is not prudent to rely on long-term investments – including the savings component of your retirement funds – as they are specifically intended to meet long-term goals and are typically invested accordingly, with relatively high equity exposure.

While equities are the best way to ensure your portfolio beats inflation over the long term, market ups and downs are to be expected. This means that equities are not well suited for short-term savings or emergency funds, because if you need cash during a market downturn, you may be forced to sell at a low, locking in losses. An appropriately invested emergency fund can help you avoid this scenario.

Blurring the lines

While the changes to the retirement system are helpful to those in financial distress, they may stir up temptation to withdraw for non-emergency purposes. However, withdrawing from your savings component can cost you more than you think down the line – both in terms of losing out on growth and due to the punitive tax implications.

Example: You are about to turn 40 and decide to make a withdrawal of R30 000 from your savings component to fund your birthday party. After all, you are only going to retire at 65 and can easily replenish the amount.

Before you go ahead, you may want to consider the following:

- You may only be withdrawing R30 000 today, but assuming above-inflation returns of 5% per year, your withdrawal is just above R100 000 of your future retirement savings, in today's money terms.

- You are unlikely to receive R30 000 in your bank account. The funds will form part of your gross income for the tax year and will be taxed at your marginal tax rate, which means you will only receive the after-tax amount.

- You could be pushed into a higher tax bracket for the year of assessment.

Stick to your objectives

By setting out clear investment objectives and making a concerted effort to build up emergency reserves that are separate from your long-term investments, you can preserve your long-term investments for their intended purpose, while having enough reserves to protect you against the unpredictability of life.