First published in August 2024

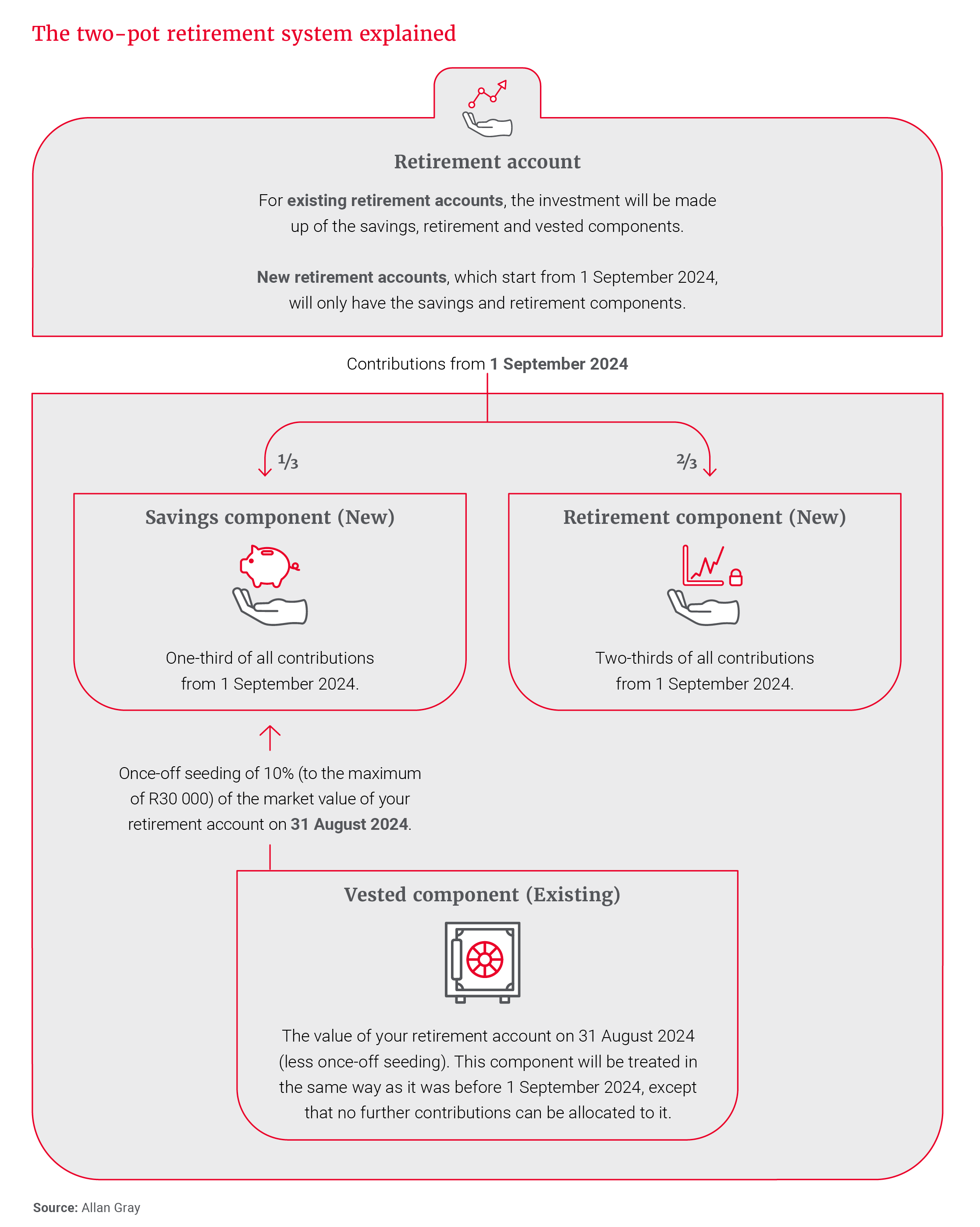

Given the overwhelming amount of information available about the two-pot retirement system, below we provide a “cheat sheet”, which includes 10 “did you knows” and an infographic, which we hope will be a useful overview for members, employers and advisers.

Did you know?

1. Two pots – but one investment

As of 1 September 2024, all contributions to retirement funds are split into two components, as shown in the infographic below: One-third of the contributions are allocated to a savings component, which members can access once a year before retirement, and the remaining two-thirds are allocated to a retirement component, which is inaccessible before a member retires, and at retirement must be used to purchase a retirement income product. Any accumulated retirement investments up until 31 August 2024 (less once-off seeding of the savings component, as explained later on) have been placed in a vested component, and the fund rules that applied on that date will continue to apply. No further contributions can be allocated to this component.

While the two-pot system offers a measure of flexibility by providing some access to savings in case of severe financial stress, it should not change how you think about or invest your retirement savings. You should view the components in your retirement account holistically and remain invested in funds that offer you the best chance of having sufficient savings to provide an adequate post-retirement income.

2. Your savings pot received a once-off opening balance

Your savings component was funded with an initial once-off amount transferred from your vested component through a process called “seeding”. The amount seeded was equal to 10% of the market value of your account on 31 August 2024, subject to a maximum of R30 000.

3. Retirement savings accumulated before two-pot are not subject to the new rules

The existing value of your retirement account on 31 August 2024 (your vested component plus future growth) was not impacted by the implementation of two-pot – other than the amount that was deducted for seeding. You will not be able to make further contributions to the vested component.

4. Withdrawals could reduce your retirement savings by up to one-third

Accessing your savings component before retirement will reduce the amount you will have available at retirement to purchase a retirement income product or to take as a cash lump sum. It also robs you of the full benefit of compounding.

5. You are unlikely to get the withdrawal amount you request

Withdrawals from your savings component are taxed at your marginal tax rate, which is the highest rate of tax that is applicable to you, according to the personal income tax table. These taxes are higher than those applied at retirement if you decide to take your savings component assets, or a portion thereof, as a cash lump sum at that point. You will receive the after-tax amount, less any outstanding taxes you may owe to SARS.

6. You may find yourself in a higher tax bracket

You could be pushed into a higher tax bracket for the year of assessment as SARS will include the withdrawal when calculating your marginal tax rate.

7. You only get one withdrawal per tax year

Even if you only make a partial withdrawal from your savings component, you are not allowed to make another withdrawal until the following tax year. Tax years run from the beginning of March to the end of February.

8. There are no penalties for not withdrawing from the savings component

The amount that is invested in your savings component remains invested and will continue to grow. The full amount, less applicable taxes, will be available to you once, annually.

9. Certain members were excluded, but can choose to opt in

If you have been a member of a provident fund since before 1 March 2021, and you were 55 or older on that date, you were automatically excluded from the implementation of the two-pot system, and it would not have had any impact on you for this specific investment. You are, however, able to opt in if you would like to.

10. The two-pot retirement system's rules alone do not ensure an appropriate and sustainable income in retirement

While the two-pot retirement system assists with better preservation, it is still up to you to avoid the withdrawal temptation and invest appropriately for real returns.